Most Woke Liberal Companies – #1 Disney 2 years running

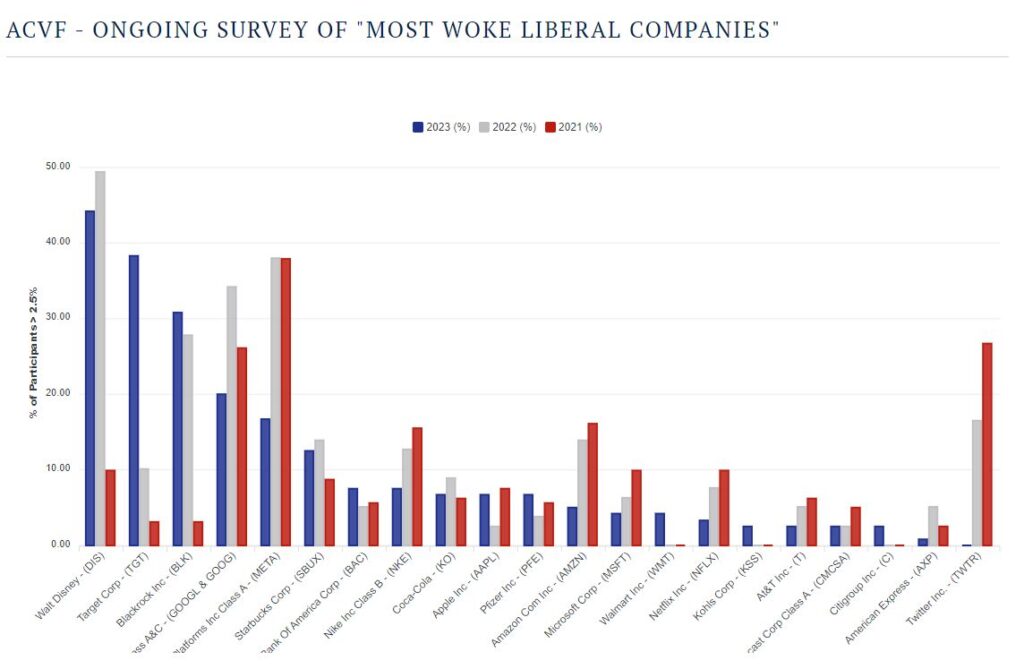

Today, the American Conservative Values ETF’s (NYSE:ACVF) released the latest results of its ongoing survey of the Most Woke Liberal companies.

ACVF asked its investors and subscribers to nominate their top three most woke liberal S&P 500 companies, with the prompt ‘Which Companies are the Most Antithetical to your Conservative Ideals, Beliefs, and Values?’

“It’s an ongoing informal survey intended to identify companies with woke or liberal reputations, as well as capture trends over time,” states ACVF CEO and co-founder William Flaig. “It’s intended to capture the insights and perspectives of politically conservative investors.”

| Most Woke liberal companies in America – ACVF’s 2023 Survey Results |

| 1 – Walt Disney (DIS) |

| 2 – Target Corp (TGT) |

| 3 – Blackrock Inc (BLK) |

| 4 – Alphabet Inc (GOOGL & GOOG) |

| 5 – Meta Platforms Inc (META) |

| 6 – Starbucks Corp (SBUX) |

| 7 – Bank Of America Corp (BAC) |

| 8 – Nike Inc (NKE) |

| 9 – CocaCola (KO) |

| 10 – Apple Inc (AAPL) |

| 11 – Pfizer Inc (PFE) |

| 12 – Amazon Com Inc (AMZN) |

| 13 – Microsoft Corp (MSFT) |

| 14 – Walmart Inc (WMT) |

| 15 – Netflix Inc (NFLX) |

Over 40% of survey participants nominated Disney as the most woke liberal company for the second year in a row. Target and Blackrock were second and third displacing Alphabeta and Meta (Facebook), which were both amongst the top three in 2022 and 2021.

“The significant changes to the rankings of Target and Blackrock clearly reflect their recent negative headlines,” Flaig noted.

“The focus of corporations should be on shareholder returns and providing goods and services to consumers, not weighing in on social and political issues which alienate consumers and investors,” said ACVF’s president and co-founder Thomas Carter. “The fact that playing politics alienates investors and customers should be on the minds of CEOs and their boards of directors.”

ACVF’s priority is shareholder returns and the fund provides an investment alternative for politically conservative investors. Simply put, ACVF seeks to boycott as many companies hostile to conservative values as possible without sacrificing performance.

Disney and all of the other Top 10 Wokest Liberal companies are among the 35 corporations that ACVF currently boycotts. Collectively, these corporations represent approximately 25% of the S&P 500’s weightings.

ACVF’s President and co-founder, Tom Carter said, “It’s clear Disney’s adoption of left-wing ideology led by its war on parental rights continues to harm the company’s brand among politically conservative investors.”

Tom Carter reiterated that “we do not want to give the companies that are eagerly working to destroy conservative values our hard-earned investment dollars, and neither should you. Companies like Walt Disney, Blackrock, Google, Amazon, and others.”

Links

Factsheet

InvestConservative.com

30sec Video

Fund Material

*The S&P 500® is a broad-based unmanaged index, which is widely recognized as representative of the equity market in general.

The American Conservative Values ETF (ACVF) is based on the conviction that politically active companies negatively impact their shareholder returns, as well as support issues and causes which conflict with our conservative political ideals, beliefs and values.

About ACVF

*The S&P 500® is a broad-based unmanaged index, which is widely recognized as representative of the equity market in general.

* As of 2/16/2024 the fund holds 0.00% of Disney, Blackrock, Google and Amazon. The fund’s holdings are subject to change. For current holdings, please visit https://acvetfs.com/fund/etf-fund/#holdings

* The 35 companies that are currently excluded from their portfolio represent 25% of the S&P 500.

* For current holdings, fund factsheet and more information, please visit www.acvetfs.com

To schedule an interview with Mr. Flaig or Mr. Carter, please contact them at:

wflaig@ridgelineresearch.com

301-685-7121

tcarter@ridgelineresearch.com

301-685-7122

Carefully consider the Fund’s investment objectives, risk factors, charges and expenses before investing. This and additional information can be found in the Fund’s prospectus and summary prospectus, which may be obtained by visiting ACVETFS.com. Read the prospectus and summary prospectus carefully before investing.

An investment in the Fund is subject to risks, including the possible loss of the principal amount invested. Overall stock market risks may affect the value of individual securities in which the Fund invests. The Fund is actively managed, and the adviser’s investment decisions impact the Fund’s performance. The Fund and adviser are new, and the ETF has only recently commenced operations. This Fund may not be suitable for all investors.

The equity securities in which the Fund invests will generally be those of companies with large market capitalizations. Exchange-Traded Funds (ETFs) trade like stocks, are subject to investment risk, and will fluctuate in market value. Transactions in shares of ETFs will result in brokerage commissions, which will reduce returns. Unlike typical exchange-traded funds, there are no indexes that the Fund attempts to track or replicate. Thus, the ability of the Fund to achieve its objectives will depend on the effectiveness of the portfolio manager. There is no assurance that the investment process will consistently lead to successful investing. The Fund is new and has a limited operating history.

The ACVF Fund is distributed by Foreside Fund Services, LLC.

SOURCE: American Conservative Values ETF

SOURCE: American Conservative Values ETF