ETF Fund DATA

FUND NAME:

TICKER:

LAUNCH DATE:

MANAGEMENT STYLE:

Active

CUSIP:

TOTAL GROSS EXPENSE RATIO:

ASSET CLASS:

EXCHANGE:

ADVISOR:

IPOV TICKER SYMBOL*:

AS OF DATE:

NAV ($)**

MARKET PRICE ($)***

PREMIUM / DISCOUNT (%)

30 DAY MEDIAN BID/ASK SPREAD****

SHARES OUTSTANDING

TOTAL NET ASSETS

$80,465,463

*IOPV, or Indicative Optimized Portfolio Value, is a calculation disseminated by the stock exchange that approximates the Fund’s NAV every fifteen seconds throughout the trading day.

**“Net asset value” or “NAV” is determined by adding up the value of all the assets in the fund, including assets and cash, subtracting any liabilities, and then dividing that value by the number of outstanding shares in the ETF.

***Market Price is defined as the official closing price of the ETF share.

****30-Day Median Bid/Ask Percentage Spread Calculation: Based on Rule 6c-11(c)(1)(v), to calculate the median bid-ask spread the fund, (i) identifies the ETF’s NBBO as of the end of each 10-second interval during each trading day of the last 30 calendar days; (ii) divides the difference between each such bid and offer by the midpoint of the NBBO; and (iii) identify the median of those values.

PREMIUM/DISCOUNT

NUMBER OF DAYS AT

Cal. Year 2023

First QTR 2024

PREMIUM*

DISCOUNT**

TOTAL

PREMIUM*

Cal. Year 2022

1 QTR 2023

2 QTR 2023

3 QTR 2023

DISCOUNT*

Cal. Year 2022

1 QTR 2023

2 QTR 2023

3 QTR 2023

TOTAL

Cal. Year 2022

1 QTR 2023

2 QTR 2023

3 QTR 2023

*Premium – The number of trading days the ETF’s closing price exceeds its NAV.

**Discount – The number of trading days the ETF’s closing price is below its NAV.

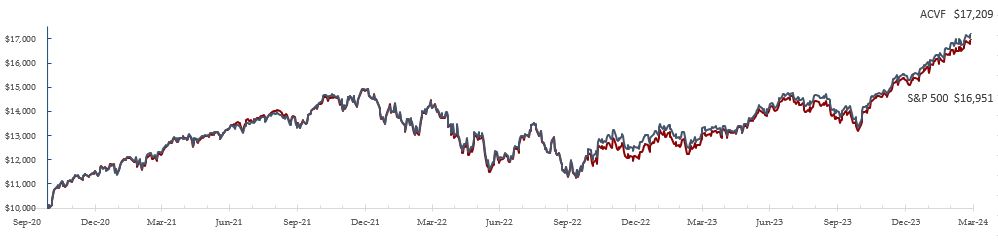

PERFORMANCE & GROWTH of $10K

(as of March 31st, 2024)

QTD

6 MTH

YTD

1 YR

2 YR*

3 YR*

INCEPTION (1)*

ACVF–Market Close

ACVF-NAV

S&P 500 Index

ACVF – Market (Close)(1)

QTD

6 MTH

YTD

1 YR

INCEPTION Annualized(1)

ACVF–NAV

QTD

6 MTH

YTD

1 YR

INCEPTION Annualized(1)

S&P 500 Index

QTD

6 MTH

YTD

1 YR

INCEPTION Annualized(1)

(1) Since Inception Returns are annualized and calculated using 10/28/20 NAV and Index Values. *Performance returns for periods greater than one year are annualized.

Performance is shown net of fees. The performance data quoted represents past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than their original cost and current performance may be lower or higher than the performance quoted. Performance current to the most recent month-end can be obtained by calling (888) 909-6030.

PORTFOLIO HOLDINGS

| Effective Date | as_of_date | etf_ticker | Ticker | Holding Name | Market Value % | Market Value $ | Security ID | constituent_isin | constituent_figi | constituent_sedol | Shares / Quantity |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 04/19/2024 | 04/19/2024 | ACVF | MSFT | MICROSOFT CORP | 5.13 | 4,128,098 | 594918104 | US5949181045 | BBG000BPH459 | 2588173 | 10,343 |

| 04/19/2024 | 04/19/2024 | ACVF | NVDA | NVIDIA CORP | 4.99 | 4,014,978 | 67066G104 | US67066G1040 | BBG000BBJQV0 | 2379504 | 5,269 |

| 04/19/2024 | 04/19/2024 | ACVF | BRK/B | BERKSHIRE HATHAWAY INC-CL B | 2.87 | 2,307,335 | 84670702 | US0846707026 | BBG000DWG505 | 2073390 | 5,696 |

| 04/19/2024 | 04/19/2024 | ACVF | MA | MASTERCARD INC - A | 1.78 | 1,432,656 | 57636Q104 | US57636Q1040 | BBG000F1ZSQ2 | B121557 | 3,146 |

| 04/19/2024 | 04/19/2024 | ACVF | PG | PROCTER & GAMBLE CO/THE | 1.74 | 1,397,957 | 742718109 | US7427181091 | BBG000BR2TH3 | 2704407 | 8,840 |

| 04/19/2024 | 04/19/2024 | ACVF | HD | HOME DEPOT INC | 1.74 | 1,397,109 | 437076102 | US4370761029 | BBG000BKZB36 | 2434209 | 4,166 |

| 04/19/2024 | 04/19/2024 | ACVF | AVGO | Broadcom Inc. | 1.67 | 1,345,661 | 11135F101 | US11135F1012 | BBG00KHY5S69 | BDZ78H9 | 1,117 |

| 04/19/2024 | 04/19/2024 | ACVF | XOM | EXXON MOBIL CORP | 1.67 | 1,344,574 | 30231G102 | US30231G1022 | BBG000GZQ728 | 2326618 | 11,216 |

| 04/19/2024 | 04/19/2024 | ACVF | LLY | ELI LILLY & CO | 1.59 | 1,279,031 | 532457108 | US5324571083 | BBG000BNBDC2 | 2516152 | 1,761 |

| 04/19/2024 | 04/19/2024 | ACVF | COST | COSTCO WHOLESALE CORP | 1.57 | 1,264,346 | 22160K105 | US22160K1051 | BBG000F6H8W8 | 2701271 | 1,782 |

| 04/19/2024 | 04/19/2024 | ACVF | CSCO | CISCO SYSTEMS INC | 1.56 | 1,251,439 | 17275R102 | US17275R1023 | BBG000C3J3C9 | 2198163 | 25,899 |

| 04/19/2024 | 04/19/2024 | ACVF | PEP | PEPSICO INC | 1.14 | 916,968 | 713448108 | US7134481081 | BBG000DH7JK6 | 2681511 | 5,266 |

| 04/19/2024 | 04/19/2024 | ACVF | MCD | MCDONALDS CORP | 1.10 | 888,319 | 580135101 | US5801351017 | BBG000BNSZP1 | 2550707 | 3,266 |

| 04/19/2024 | 04/19/2024 | ACVF | ADBE | ADOBE SYSTEMS INC | 1.03 | 825,410 | 00724F101 | US00724F1012 | BBG000BB5006 | 2008154 | 1,775 |

| 04/19/2024 | 04/19/2024 | ACVF | TSLA | Tesla Inc. | 1.02 | 824,068 | 88160R101 | US88160R1014 | BBG000N9MNX3 | B616C79 | 5,604 |

| 04/19/2024 | 04/19/2024 | ACVF | MRK | MERCK & CO. INC. | 1.00 | 803,482 | 58933Y105 | US58933Y1055 | BBG000BPD168 | 2778844 | 6,388 |

| 04/19/2024 | 04/19/2024 | ACVF | LIN | LINDE PLC | 1.00 | 801,108 | G54950103 | IE000S9YS762 | BBG01FND0CC1 | BNZHB81 | 1,795 |

| 04/19/2024 | 04/19/2024 | ACVF | INTU | INTUIT INC | 0.94 | 755,252 | 461202103 | US4612021034 | BBG000BH5DV1 | 2459020 | 1,248 |

| 04/19/2024 | 04/19/2024 | ACVF | ACN | ACCENTURE PLC-CL A | 0.90 | 726,605 | G1151C101 | IE00B4BNMY34 | BBG000D9D830 | B4BNMY3 | 2,293 |

| 04/19/2024 | 04/19/2024 | ACVF | ABBV | ABBVIE INC | 0.90 | 723,550 | 00287Y109 | US00287Y1091 | BBG0025Y4RY4 | B92SR70 | 4,348 |

| 04/19/2024 | 04/19/2024 | ACVF | CVX | CHEVRON CORP | 0.88 | 708,640 | 166764100 | US1667641005 | BBG000K4ND22 | 2838555 | 4,429 |

| 04/19/2024 | 04/19/2024 | ACVF | ORCL | ORACLE CORP | 0.86 | 690,543 | 68389X105 | US68389X1054 | BBG000BQLTW7 | 2661568 | 6,011 |

| 04/19/2024 | 04/19/2024 | ACVF | TMUS | T-MOBILE US INC | 0.85 | 680,649 | 872590104 | US8725901040 | BBG000NDV1D4 | B94Q9V0 | 4,193 |

| 04/19/2024 | 04/19/2024 | ACVF | TJX | TJX COMPANIES INC | 0.81 | 653,893 | 872540109 | US8725401090 | BBG000BV8DN6 | 2989301 | 7,004 |

| 04/19/2024 | 04/19/2024 | ACVF | MDLZ | MONDELEZ INTERNATIONAL INC-A | 0.80 | 646,704 | 609207105 | US6092071058 | BBG000D4LWF6 | B8CKK03 | 9,495 |

| 04/19/2024 | 04/19/2024 | ACVF | BKNG | BOOKING HOLDINGS INC | 0.78 | 628,326 | 09857L108 | US09857L1089 | BBG000BLBVN4 | BDRXDB4 | 184 |

| 04/19/2024 | 04/19/2024 | ACVF | NOW | SERVICENOW INC | 0.78 | 627,526 | 81762P102 | US81762P1021 | BBG000M1R011 | B80NXX8 | 879 |

| 04/19/2024 | 04/19/2024 | ACVF | SO | SOUTHERN CO/THE | 0.74 | 593,505 | 842587107 | US8425871071 | BBG000BT9DW0 | 2829601 | 8,226 |

| 04/19/2024 | 04/19/2024 | ACVF | CI | CIGNA CORP | 0.74 | 593,072 | 125523100 | US1255231003 | BBG00KXRCDP0 | BHJ0775 | 1,683 |

| 04/19/2024 | 04/19/2024 | ACVF | WFC | WELLS FARGO & CO | 0.70 | 563,608 | 949746101 | US9497461015 | BBG000BWQFY7 | 2649100 | 9,339 |

| 04/19/2024 | 04/19/2024 | ACVF | AMD | ADVANCED MICRO DEVICES INC | 0.70 | 561,484 | 7903107 | US0079031078 | BBG000BBQCY0 | 2007849 | 3,829 |

| 04/19/2024 | 04/19/2024 | ACVF | MSI | MOTOROLA SOLUTIONS INC | 0.68 | 545,477 | 620076307 | US6200763075 | BBG000BP8Z50 | B5BKPQ4 | 1,606 |

| 04/19/2024 | 04/19/2024 | ACVF | FI | FISERV INC | 0.66 | 533,099 | 337738108 | US3377381088 | BBG000BJKPG0 | 2342034 | 3,587 |

| 04/19/2024 | 04/19/2024 | ACVF | AMAT | APPLIED MATERIALS INC | 0.65 | 519,780 | 38222105 | US0382221051 | BBG000BBPFB9 | 2046552 | 2,739 |

| 04/19/2024 | 04/19/2024 | ACVF | TMO | THERMO FISHER SCIENTIFIC INC | 0.63 | 506,645 | 883556102 | US8835561023 | BBG000BVDLH9 | 2886907 | 930 |

| 04/19/2024 | 04/19/2024 | ACVF | QCOM | QUALCOMM INC | 0.61 | 494,012 | 747525103 | US7475251036 | BBG000CGC1X8 | 2714923 | 3,134 |

| 04/19/2024 | 04/19/2024 | ACVF | ETN | EATON CORP PLC | 0.60 | 485,438 | G29183103 | IE00B8KQN827 | BBG000BJ3PD2 | B8KQN82 | 1,602 |

| 04/19/2024 | 04/19/2024 | ACVF | SPGI | S&P GLOBAL INC | 0.60 | 485,170 | 78409V104 | US78409V1044 | BBG000BP1Q11 | BYV2325 | 1,176 |

| 04/19/2024 | 04/19/2024 | ACVF | CPRT | COPART INC | 0.59 | 476,977 | 217204106 | US2172041061 | BBG000BM9RH1 | 2208073 | 9,020 |

| 04/19/2024 | 04/19/2024 | ACVF | UBER | UBER TECHNOLOGIES INC | 0.59 | 476,026 | 90353T100 | US90353T1007 | BBG002B04MT8 | BK6N347 | 6,879 |

| 04/19/2024 | 04/19/2024 | ACVF | DHR | DANAHER CORP | 0.57 | 459,715 | 235851102 | US2358511028 | BBG000BH3JF8 | 2250870 | 1,952 |

| 04/19/2024 | 04/19/2024 | ACVF | ABT | ABBOTT LABORATORIES COMMON STOCK USD 0 | 0.57 | 454,974 | 2824100 | US0028241000 | BBG000B9ZXB4 | 2002305 | 4,241 |

| 04/19/2024 | 04/19/2024 | ACVF | CAT | CATERPILLAR INC | 0.56 | 452,900 | 149123101 | US1491231015 | BBG000BF0K17 | 2180201 | 1,277 |

| 04/19/2024 | 04/19/2024 | ACVF | LRCX | LAM RESEARCH CORP | 0.55 | 441,216 | 512807108 | US5128071082 | BBG000BNFLM9 | 2502247 | 507 |

| 04/19/2024 | 04/19/2024 | ACVF | SNPS | SYNOPSYS INC | 0.55 | 439,721 | 871607107 | US8716071076 | BBG000BSFRF3 | 2867719 | 861 |

| 04/19/2024 | 04/19/2024 | ACVF | NEE | NEXTERA ENERGY INC | 0.53 | 425,730 | 65339F101 | US65339F1012 | BBG000BJSBJ0 | 2328915 | 6,621 |

| 04/19/2024 | 04/19/2024 | ACVF | ELV | ELEVANCE HEALTH INC COMMON STOCK USD 0.01 | 0.53 | 425,667 | 36752103 | US0367521038 | BBG000BCG930 | BSPHGL4 | 801 |

| 04/19/2024 | 04/19/2024 | ACVF | INTC | INTEL CORP | 0.53 | 423,567 | 458140100 | US4581401001 | BBG000C0G1D1 | 2463247 | 12,385 |

| 04/19/2024 | 04/19/2024 | ACVF | ABNB | AIRBNB INC | 0.52 | 420,232 | 9066101 | US0090661010 | BBG001Y2XS07 | BMGYYH4 | 2,711 |

| 04/19/2024 | 04/19/2024 | ACVF | PM | PHILIP MORRIS INTERNATIONAL | 0.52 | 419,808 | 718172109 | US7181721090 | BBG000J2XL74 | B2PKRQ3 | 4,477 |

| 04/19/2024 | 04/19/2024 | ACVF | TXN | TEXAS INSTRUMENTS INC | 0.52 | 419,000 | 882508104 | US8825081040 | BBG000BVV7G1 | 2885409 | 2,624 |

| 04/19/2024 | 04/19/2024 | ACVF | ANET | ARISTA NETWORKS INC | 0.52 | 418,845 | 40413106 | US0404131064 | BBG000N2HDY5 | BN33VM5 | 1,702 |

| 04/19/2024 | 04/19/2024 | ACVF | ROP | ROPER TECHNOLOGIES INC | 0.52 | 414,678 | 776696106 | US7766961061 | BBG000F1ZSN5 | 2749602 | 776 |

| 04/19/2024 | 04/19/2024 | ACVF | ISRG | INTUITIVE SURGICAL INC | 0.51 | 411,766 | 46120E602 | US46120E6023 | BBG000BJPDZ1 | 2871301 | 1,124 |

| 04/19/2024 | 04/19/2024 | ACVF | ORLY | OREILLY AUTOMOTIVE INC | 0.51 | 410,193 | 67103H107 | US67103H1077 | BBG000BGYWY6 | B65LWX6 | 376 |

| 04/19/2024 | 04/19/2024 | ACVF | CDNS | CADENCE DESIGN SYS INC | 0.50 | 405,802 | 127387108 | US1273871087 | BBG000C13CD9 | 2302232 | 1,448 |

| 04/19/2024 | 04/19/2024 | ACVF | CME | CME GROUP INC | 0.50 | 403,923 | 12572Q105 | US12572Q1058 | BBG000BHLYP4 | 2965839 | 1,896 |

| 04/19/2024 | 04/19/2024 | ACVF | WM | WASTE MANAGEMENT INC | 0.49 | 393,847 | 94106L109 | US94106L1098 | BBG000BWVSR1 | 2937667 | 1,902 |

| 04/19/2024 | 04/19/2024 | ACVF | MAR | Marriott International, Inc Class A | 0.48 | 383,500 | 571903202 | US5719032022 | BBG000BGD7W6 | 2210614 | 1,625 |

| 04/19/2024 | 04/19/2024 | ACVF | HON | HONEYWELL INTERNATIONAL INC | 0.47 | 378,612 | 438516106 | US4385161066 | BBG000H556T9 | 2020459 | 1,949 |

| 04/19/2024 | 04/19/2024 | ACVF | C | CITIGROUP INC | 0.46 | 371,813 | 172967424 | US1729674242 | BBG000FY4S11 | 2297907 | 6,287 |

| 04/19/2024 | 04/19/2024 | ACVF | ADI | ANALOG DEVICES INC | 0.46 | 368,736 | 32654105 | US0326541051 | BBG000BB6G37 | 2032067 | 2,011 |

| 04/19/2024 | 04/19/2024 | ACVF | UNP | UNION PACIFIC CORP | 0.44 | 354,386 | 907818108 | US9078181081 | BBG000BW3299 | 2914734 | 1,527 |

| 04/19/2024 | 04/19/2024 | ACVF | GE | GENERAL ELECTRIC CO | 0.44 | 353,715 | 369604301 | US3696043013 | BL59CR9 | 2,389 | |

| 04/19/2024 | 04/19/2024 | ACVF | RTX | RTX Corp. | 0.43 | 346,116 | 7.55E+105 | US75513E1010 | BBG000BW8S60 | BM5M5Y3 | 3,408 |

| 04/19/2024 | 04/19/2024 | ACVF | MPC | MARATHON PETROLEUM CORP | 0.42 | 335,417 | 56585A102 | US56585A1025 | BBG001DCCGR8 | B3K3L40 | 1,708 |

| 04/19/2024 | 04/19/2024 | ACVF | VRSN | VERISIGN INC | 0.41 | 332,336 | 9.23E+106 | US92343E1029 | BBG000BGKHZ3 | 2142922 | 1,805 |

| 04/19/2024 | 04/19/2024 | ACVF | MU | MICRON TECHNOLOGY INC | 0.41 | 325,862 | 595112103 | US5951121038 | BBG000C5Z1S3 | 2588184 | 3,052 |

| 04/19/2024 | 04/19/2024 | ACVF | RSG | REPUBLIC SERVICES INC | 0.40 | 322,402 | 760759100 | US7607591002 | BBG000BPXVJ6 | 2262530 | 1,699 |

| 04/19/2024 | 04/19/2024 | ACVF | PANW | PALO ALTO NETWORKS INC | 0.40 | 321,588 | 697435105 | US6974351057 | BBG0014GJCT9 | B87ZMX0 | 1,158 |

| 04/19/2024 | 04/19/2024 | ACVF | AMGN | AMGEN INC | 0.40 | 320,564 | 31162100 | US0311621009 | BBG000BBS2Y0 | 2023607 | 1,192 |

| 04/19/2024 | 04/19/2024 | ACVF | CB | CHUBB LIMITED | 0.40 | 319,768 | H1467J104 | CH0044328745 | BBG000BR14K5 | B3BQMF6 | 1,278 |

| 04/19/2024 | 04/19/2024 | ACVF | MCO | Moodys Corporation | 0.39 | 317,345 | 615369105 | US6153691059 | BBG000F86GP6 | 2252058 | 847 |

| 04/19/2024 | 04/19/2024 | ACVF | ICE | INTERCONTINENTAL EXCHANGE IN | 0.39 | 310,574 | 45866F104 | US45866F1049 | BBG000C1FB75 | BFSSDS9 | 2,367 |

| 04/19/2024 | 04/19/2024 | ACVF | GRMN | GARMIN LTD | 0.36 | 292,433 | H2906T109 | CH0114405324 | BBG000C4LN67 | B3Z5T14 | 2,096 |

| 04/19/2024 | 04/19/2024 | ACVF | ADP | AUTOMATIC DATA PROCESSING | 0.36 | 290,998 | 53015103 | US0530151036 | BBG000JG0547 | 2065308 | 1,196 |

| 04/19/2024 | 04/19/2024 | ACVF | KLAC | KLA Corporation | 0.36 | 287,697 | 482480100 | US4824801009 | BBG000BMTFR4 | 2480138 | 458 |

| 04/19/2024 | 04/19/2024 | ACVF | PLD | PROLOGIS INC | 0.35 | 283,769 | 74340W103 | US74340W1036 | BBG000B9Z0J8 | B44WZD7 | 2,742 |

| 04/19/2024 | 04/19/2024 | ACVF | BMY | BRISTOL-MYERS SQUIBB CO | 0.35 | 283,353 | 110122108 | US1101221083 | BBG000DQLV23 | 2126335 | 5,791 |

| 04/19/2024 | 04/19/2024 | ACVF | CTAS | CINTAS CORP | 0.35 | 282,370 | 172908105 | US1729081059 | BBG000H3YXF8 | 2197137 | 427 |

| 04/19/2024 | 04/19/2024 | ACVF | ROST | ROSS STORES INC | 0.35 | 278,947 | 778296103 | US7782961038 | BBG000BSBZH7 | 2746711 | 2,092 |

| 04/19/2024 | 04/19/2024 | ACVF | LMT | LOCKHEED MARTIN CORP | 0.34 | 275,074 | 539830109 | US5398301094 | BBG000C1BW00 | 2522096 | 593 |

| 04/19/2024 | 04/19/2024 | ACVF | SPOT | SPOTIFY TECHNOLOGY SA | 0.34 | 274,175 | L8681T102 | LU1778762911 | BBG003T4VFC2 | BFZ1K46 | 994 |

| 04/19/2024 | 04/19/2024 | ACVF | CHTR | CHARTER COMMUNICATIONS INC-A | 0.34 | 273,431 | 16119P108 | US16119P1084 | BBG000VPGNR2 | BZ6VT82 | 1,031 |

| 04/19/2024 | 04/19/2024 | ACVF | DE | DEERE & CO | 0.34 | 273,018 | 244199105 | US2441991054 | BBG000BH1NH9 | 2261203 | 682 |

| 04/19/2024 | 04/19/2024 | ACVF | BX | BLACKSTONE GROUP INC/THE | 0.33 | 262,611 | 09260D107 | US09260D1072 | BKF2SL7 | 2,218 | |

| 04/19/2024 | 04/19/2024 | ACVF | OMC | OMNICOM GROUP | 0.32 | 258,595 | 681919106 | US6819191064 | BBG000BS9489 | 2279303 | 2,792 |

| 04/19/2024 | 04/19/2024 | ACVF | AZO | AUTOZONE INC | 0.32 | 253,770 | 53332102 | US0533321024 | BBG000C7LMS8 | 2065955 | 85 |

| 04/19/2024 | 04/19/2024 | ACVF | SYK | STRYKER CORP | 0.31 | 249,604 | 863667101 | US8636671013 | BBG000DN7P92 | 2853688 | 767 |

| 04/19/2024 | 04/19/2024 | ACVF | MDT | MEDTRONIC PLC | 0.31 | 248,851 | G5960L103 | IE00BTN1Y115 | BBG000BNWG87 | BTN1Y11 | 3,131 |

| 04/19/2024 | 04/19/2024 | ACVF | CMG | CHIPOTLE MEXICAN GRILL INC | 0.31 | 246,743 | 169656105 | US1696561059 | BBG000QX74T1 | B0X7DZ3 | 86 |

| 04/19/2024 | 04/19/2024 | ACVF | COP | CONOCOPHILLIPS | 0.30 | 242,975 | 20825C104 | US20825C1045 | BBG000BQQH30 | 2685717 | 1,878 |

| 04/19/2024 | 04/19/2024 | ACVF | VRSK | VERISK ANALYTICS INC | 0.30 | 238,318 | 92345Y106 | US92345Y1064 | BBG000BCZL41 | B4P9W92 | 1,071 |

| 04/19/2024 | 04/19/2024 | ACVF | VRTX | VERTEX PHARMACEUTICALS INC | 0.30 | 238,145 | 92532F100 | US92532F1003 | BBG000C1S2X2 | 2931034 | 604 |

| 04/19/2024 | 04/19/2024 | ACVF | DFS | DISCOVER FINANCIAL SERVICES | 0.29 | 236,911 | 254709108 | US2547091080 | BBG000QBR5J5 | B1YLC43 | 1,890 |

| 04/19/2024 | 04/19/2024 | ACVF | PNC | PNC FINANCIAL SERVICES GROUP | 0.29 | 234,998 | 693475105 | US6934751057 | BBG000BRD0D8 | 2692665 | 1,543 |

| 04/19/2024 | 04/19/2024 | ACVF | REGN | REGENERON PHARMACEUTICALS | 0.29 | 234,070 | 75886F107 | US75886F1075 | BBG000C734W3 | 2730190 | 261 |

| 04/19/2024 | 04/19/2024 | ACVF | EXPE | EXPEDIA GROUP INC | 0.28 | 228,975 | 30212P303 | US30212P3038 | BBG000QY3XZ2 | B748CK2 | 1,775 |

| 04/19/2024 | 04/19/2024 | ACVF | MCK | MCKESSON CORP | 0.28 | 224,627 | 58155Q103 | US58155Q1031 | BBG000DYGNW7 | 2378534 | 428 |

| 04/19/2024 | 04/19/2024 | ACVF | MMC | MARSH & MCLENNAN COS | 0.28 | 223,865 | 571748102 | US5717481023 | BBG000BP4MH0 | 2567741 | 1,106 |

| 04/19/2024 | 04/19/2024 | ACVF | DASH | DOORDASH INC CLASS A | 0.28 | 222,183 | 25809K105 | US25809K1051 | BBG005D7QCJ3 | BN13P03 | 1,747 |

| 04/19/2024 | 04/19/2024 | ACVF | UPS | UNITED PARCEL SERVICE-CL B | 0.27 | 217,581 | 911312106 | US9113121068 | BBG000L9CV04 | 2517382 | 1,524 |

| 04/19/2024 | 04/19/2024 | ACVF | MS | MORGAN STANLEY | 0.27 | 215,952 | 617446448 | US6174464486 | BBG000BLZRJ2 | 2262314 | 2,382 |

| 04/19/2024 | 04/19/2024 | ACVF | BSX | BOSTON SCIENTIFIC CORP | 0.26 | 212,156 | 101137107 | US1011371077 | BBG000C0LW92 | 2113434 | 3,151 |

| 04/19/2024 | 04/19/2024 | ACVF | MET | METLIFE INC | 0.26 | 211,978 | 59156R108 | US59156R1086 | BBG000BB6KF5 | 2573209 | 2,981 |

| 04/19/2024 | 04/19/2024 | ACVF | EA | ELECTRONIC ARTS INC | 0.26 | 209,995 | 285512109 | US2855121099 | BBG000BP0KQ8 | 2310194 | 1,650 |

| 04/19/2024 | 04/19/2024 | ACVF | CVS | CVS HEALTH CORP | 0.26 | 208,273 | 126650100 | US1266501006 | BBG000BGRY34 | 2577609 | 2,986 |

| 04/19/2024 | 04/19/2024 | ACVF | FCX | FREEPORT-MCMORAN INC | 0.25 | 203,053 | 35671D857 | US35671D8570 | BBG000BJDB15 | 2352118 | 4,093 |

| 04/19/2024 | 04/19/2024 | ACVF | ADSK | AUTODESK INC | 0.25 | 201,994 | 52769106 | US0527691069 | BBG000BM7HL0 | 2065159 | 933 |

| 04/19/2024 | 04/19/2024 | ACVF | CTSH | COGNIZANT TECH SOLUTIONS-A | 0.25 | 201,443 | 192446102 | US1924461023 | BBG000BBDV81 | 2257019 | 2,987 |

| 04/19/2024 | 04/19/2024 | ACVF | BA | BOEING CO | 0.25 | 199,708 | 97023105 | US0970231058 | BBG000BCSST7 | 2108601 | 1,176 |

| 04/19/2024 | 04/19/2024 | ACVF | USB | US BANCORP | 0.25 | 198,933 | 902973304 | US9029733048 | BBG000FFDM15 | 2736035 | 4,918 |

| 04/19/2024 | 04/19/2024 | ACVF | HUM | HUMANA INC | 0.24 | 195,028 | 444859102 | US4448591028 | BBG000BLKK03 | 2445063 | 594 |

| 04/19/2024 | 04/19/2024 | ACVF | EQIX | EQUINIX INC | 0.24 | 194,480 | 29444U700 | US29444U7000 | BBG000MBDGM6 | BVLZX12 | 260 |

| 04/19/2024 | 04/19/2024 | ACVF | CL | COLGATE-PALMOLIVE CO | 0.24 | 194,038 | 194162103 | US1941621039 | BBG000BFQYY3 | 2209106 | 2,227 |

| 04/19/2024 | 04/19/2024 | ACVF | CASH AND CASH EQUIVALENTS | 0.24 | 189,578 | 189,578 | |||||

| 04/19/2024 | 04/19/2024 | ACVF | IPG | Interpublic Group of Companies Inc. | 0.23 | 187,852 | 460690100 | US4606901001 | BBG000C90DH9 | 2466321 | 6,115 |

| 04/19/2024 | 04/19/2024 | ACVF | WDAY | WORKDAY INC-CLASS A | 0.23 | 187,399 | 98138H101 | US98138H1014 | BBG000VC0T95 | B8K6ZD1 | 743 |

| 04/19/2024 | 04/19/2024 | ACVF | GPN | GLOBAL PAYMENTS INC | 0.23 | 185,958 | 37940X102 | US37940X1028 | BBG000CX0P89 | 2712013 | 1,523 |

| 04/19/2024 | 04/19/2024 | ACVF | STZ | CONSTELLATION BRANDS INC-A | 0.22 | 177,015 | 21036P108 | US21036P1084 | BBG000J1QLT0 | 2170473 | 679 |

| 04/19/2024 | 04/19/2024 | ACVF | CSX | CSX CORP | 0.22 | 175,408 | 126408103 | US1264081035 | BBG000BGJRC8 | 2160753 | 5,108 |

| 04/19/2024 | 04/19/2024 | ACVF | FICO | FAIR ISAAC CORP | 0.22 | 175,159 | 303250104 | US3032501047 | BBG000DW76Y6 | 2330299 | 155 |

| 04/19/2024 | 04/19/2024 | ACVF | MNST | MONSTER BEVERAGE CORP | 0.21 | 172,067 | 61174X109 | US61174X1090 | BBG008NVB1C0 | BZ07BW4 | 3,238 |

| 04/19/2024 | 04/19/2024 | ACVF | SCHW | The Charles Schwab Corporation | 0.21 | 170,774 | 808513105 | US8085131055 | BBG000BSLZY7 | 2779397 | 2,326 |

| 04/19/2024 | 04/19/2024 | ACVF | HPE | HEWLETT-PACKARD ENTERPRIS | 0.21 | 169,914 | 42824C109 | US42824C1099 | BBG0078W3NQ3 | BYVYWS0 | 10,120 |

| 04/19/2024 | 04/19/2024 | ACVF | MO | ALTRIA GROUP INC | 0.21 | 168,654 | 02209S103 | US02209S1033 | BBG000BP6LJ8 | 2692632 | 4,007 |

| 04/19/2024 | 04/19/2024 | ACVF | EMR | EMERSON ELECTRIC CO | 0.21 | 166,344 | 291011104 | US2910111044 | BBG000BHX7N2 | 2313405 | 1,532 |

| 04/19/2024 | 04/19/2024 | ACVF | CBOE | CBOE HOLDINGS INC | 0.20 | 162,945 | 12503M108 | US12503M1080 | BBG000QH56C1 | B5834C5 | 901 |

| 04/19/2024 | 04/19/2024 | ACVF | SLB | SCHLUMBERGER LTD | 0.20 | 161,264 | 806857108 | AN8068571086 | BBG000BT41Q8 | 2779201 | 3,235 |

| 04/19/2024 | 04/19/2024 | ACVF | AMT | AMERICAN TOWER CORP | 0.20 | 160,679 | 03027X100 | US03027X1000 | BBG000B9XYV2 | B7FBFL2 | 938 |

| 04/19/2024 | 04/19/2024 | ACVF | NXPI | NXP Semiconductors NV | 0.20 | 160,479 | N6596X109 | NL0009538784 | BBG000BND699 | B505PN7 | 746 |

| 04/19/2024 | 04/19/2024 | ACVF | TTWO | TAKE-TWO INTERACTIVE SOFTWRE | 0.20 | 160,284 | 874054109 | US8740541094 | BBG000BS1YV5 | 2122117 | 1,140 |

| 04/19/2024 | 04/19/2024 | ACVF | ANSS | ANSYS INC | 0.20 | 159,766 | 03662Q105 | US03662Q1058 | BBG000GXZ4W7 | 2045623 | 496 |

| 04/19/2024 | 04/19/2024 | ACVF | NOC | NORTHROP GRUMMAN CORP | 0.20 | 158,664 | 666807102 | US6668071029 | BBG000BQ2C28 | 2648806 | 343 |

| 04/19/2024 | 04/19/2024 | ACVF | SHW | SHERWIN-WILLIAMS CO/THE | 0.20 | 157,263 | 824348106 | US8243481061 | BBG000BSXQV7 | 2804211 | 514 |

| 04/19/2024 | 04/19/2024 | ACVF | PARA | PARAMOUNT GLOBAL CLASS B COMMON STOCK USD.001 | 0.19 | 152,489 | 92556H206 | US92556H2067 | BBG000C496P7 | BKTNTR9 | 12,258 |

| 04/19/2024 | 04/19/2024 | ACVF | TFC | TRUIST FINANCIAL CORP | 0.19 | 150,438 | 89832Q109 | US89832Q1094 | BKP7287 | 4,088 | |

| 04/19/2024 | 04/19/2024 | ACVF | APH | AMPHENOL CORP-CL A | 0.19 | 149,831 | 32095101 | US0320951017 | BBG000B9YJ35 | 2145084 | 1,360 |

| 04/19/2024 | 04/19/2024 | ACVF | IT | Gartner Inc | 0.19 | 149,729 | 366651107 | US3666511072 | BBG000BB65D0 | 2372763 | 340 |

| 04/19/2024 | 04/19/2024 | ACVF | FFIV | F5 Inc | 0.18 | 148,247 | 315616102 | US3156161024 | BBG000CXYSZ6 | 2427599 | 836 |

| 04/19/2024 | 04/19/2024 | ACVF | CP | CANADIAN PACIFIC RAILWAY LTD | 0.18 | 145,141 | 13646K108 | CA13646K1084 | BNVTFQ7 | 1,714 | |

| 04/19/2024 | 04/19/2024 | ACVF | AMP | AMERIPRISE FINANCIAL INC | 0.18 | 144,285 | 03076C106 | US03076C1062 | BBG000G3QLY3 | B0J7D57 | 346 |

| 04/19/2024 | 04/19/2024 | ACVF | JBL | JABIL CIRCUIT INC | 0.18 | 142,856 | 466313103 | US4663131039 | BBG000BJNGN9 | 2471789 | 1,203 |

| 04/19/2024 | 04/19/2024 | ACVF | JCI | JOHNSON CONTROLS | 0.18 | 141,325 | G51502105 | IE00BY7QL619 | BBG000BVWLJ6 | BY7QL61 | 2,220 |

| 04/19/2024 | 04/19/2024 | ACVF | BDX | BECTON DICKINSON AND CO | 0.17 | 140,237 | 75887109 | US0758871091 | BBG000BCZYD3 | 2087807 | 599 |

| 04/19/2024 | 04/19/2024 | ACVF | PH | PARKER-HANNIFIN CORP COMMON STOCK USD 0.5 | 0.17 | 137,939 | 701094104 | US7010941042 | BBG000BR3KL6 | 2671501 | 258 |

| 04/19/2024 | 04/19/2024 | ACVF | BLDR | BUILDERS FIRSTSOURCE INC | 0.17 | 137,906 | 12008R107 | US12008R1077 | BBG000BKD3K9 | B0BV2M7 | 779 |

| 04/19/2024 | 04/19/2024 | ACVF | FDX | FEDEX CORP | 0.17 | 136,965 | 31428X106 | US31428X1063 | BBG000BJF1Z8 | 2142784 | 513 |

| 04/19/2024 | 04/19/2024 | ACVF | ZBRA | ZEBRA TECHNOLOGIES CORP-CL A | 0.17 | 135,911 | 989207105 | US9892071054 | BBG000CC7LQ7 | 2989356 | 507 |

| 04/19/2024 | 04/19/2024 | ACVF | AON | Aon plc | 0.17 | 132,761 | G0403H108 | IE00BLP1HW54 | BBG00SSQFPK6 | BLP1HW5 | 428 |

| 04/19/2024 | 04/19/2024 | ACVF | HLT | HILTON WORLDWIDE | 0.17 | 132,823 | 43300A203 | US43300A2033 | BBG0058KMH30 | BYVMW06 | 683 |

| 04/19/2024 | 04/19/2024 | ACVF | KKR | KKR & CO INC -A | 0.16 | 131,242 | 48251W104 | US48251W1045 | BBG000BCQ6J8 | BG1FRR1 | 1,417 |

| 04/19/2024 | 04/19/2024 | ACVF | ECL | ECOLAB INC | 0.16 | 131,114 | 278865100 | US2788651006 | BBG000BHKYH4 | 2304227 | 601 |

| 04/19/2024 | 04/19/2024 | ACVF | PCAR | PACCAR INC | 0.16 | 130,203 | 693718108 | US6937181088 | BBG000BQVTF5 | 2665861 | 1,171 |

| 04/19/2024 | 04/19/2024 | ACVF | F | FORD MOTOR CO | 0.16 | 128,878 | 345370860 | US3453708600 | BBG000BQPC32 | 2615468 | 10,616 |

| 04/19/2024 | 04/19/2024 | ACVF | ITW | ILLINOIS TOOL WORKS | 0.16 | 128,485 | 452308109 | US4523081093 | BBG000BMBL90 | 2457552 | 513 |

| 04/19/2024 | 04/19/2024 | ACVF | RBA | RB GLOBAL INC | 0.16 | 127,430 | 74935Q107 | CA74935Q1072 | BMWGSD8 | 1,755 | |

| 04/19/2024 | 04/19/2024 | ACVF | CRWD | Crowdstrike Holdings Inc. Class A | 0.16 | 126,622 | 22788C105 | US22788C1053 | BBG00BLYKS03 | BJJP138 | 448 |

| 04/19/2024 | 04/19/2024 | ACVF | EOG | EOG RESOURCES INC | 0.16 | 124,913 | 26875P101 | US26875P1012 | BBG000BZ9223 | 2318024 | 938 |

| 04/19/2024 | 04/19/2024 | ACVF | ZTS | ZOETIS INC | 0.15 | 123,792 | 98978V103 | US98978V1035 | BBG0039320N9 | B95WG16 | 845 |

| 04/19/2024 | 04/19/2024 | ACVF | CMI | CUMMINS INC | 0.15 | 123,075 | 231021106 | US2310211063 | BBG000BGPTV6 | 2240202 | 428 |

| 04/19/2024 | 04/19/2024 | ACVF | COR | Cencora, Inc. | 0.15 | 122,673 | 3.07E+108 | US03073E1055 | BBG000MDCQC2 | 2795393 | 513 |

| 04/19/2024 | 04/19/2024 | ACVF | COF | CAPITAL ONE FINANCIAL CORP | 0.15 | 122,616 | 14040H105 | US14040H1059 | BBG000BGKTF9 | 2654461 | 858 |

| 04/19/2024 | 04/19/2024 | ACVF | TT | TRANE TECHNOLOGIES PLC | 0.15 | 122,514 | G8994E103 | IE00BK9ZQ967 | BBG000BM6788 | BK9ZQ96 | 425 |

| 04/19/2024 | 04/19/2024 | ACVF | TEL | TE CONNECTIVITY LTD | 0.15 | 120,310 | H84989104 | CH0102993182 | BBG000RGM5P1 | B62B7C3 | 856 |

| 04/19/2024 | 04/19/2024 | ACVF | APD | AIR PRODUCTS & CHEMICALS INC | 0.15 | 119,526 | 9158106 | US0091581068 | BBG000BC4JJ4 | 2011602 | 516 |

| 04/19/2024 | 04/19/2024 | ACVF | MANH | MANHATTAN ASSOCIATES INC | 0.15 | 119,507 | 562750109 | US5627501092 | BBG000BFV758 | 2239471 | 528 |

| 04/19/2024 | 04/19/2024 | ACVF | OXY | OCCIDENTAL PETROLEUM CORP | 0.14 | 113,870 | 674599105 | US6745991058 | BBG000BQQ2S6 | 2655408 | 1,709 |

| 04/19/2024 | 04/19/2024 | ACVF | NUE | NUCOR CORP | 0.14 | 113,476 | 670346105 | US6703461052 | BBG000BQ8KV2 | 2651086 | 593 |

| 04/19/2024 | 04/19/2024 | ACVF | DG | DOLLAR GEN CORP NEW | 0.14 | 113,394 | 256677105 | US2566771059 | BBG000NV1KK7 | B5B1S13 | 783 |

| 04/19/2024 | 04/19/2024 | ACVF | PSA | PUBLIC STORAGE | 0.14 | 111,182 | 74460D109 | US74460D1090 | BBG000BPPN67 | 2852533 | 427 |

| 04/19/2024 | 04/19/2024 | ACVF | HPQ | HP INC | 0.14 | 110,934 | 40434L105 | US40434L1052 | BBG000KHWT55 | BYX4D52 | 3,989 |

| 04/19/2024 | 04/19/2024 | ACVF | FTNT | FORTINET INC | 0.13 | 107,463 | 3.5E+113 | US34959E1091 | BBG000BCMBG4 | B5B2106 | 1,695 |

| 04/19/2024 | 04/19/2024 | ACVF | DUK | DUKE ENERGY CORP | 0.13 | 107,376 | 26441C204 | US26441C2044 | BBG000BHGDH5 | B7VD3F2 | 1,093 |

| 04/19/2024 | 04/19/2024 | ACVF | LHX | L3HARRIS TECHNOLOGIES INC | 0.13 | 105,601 | 502431109 | US5024311095 | BBG000BLGFJ9 | BK9DTN5 | 514 |

| 04/19/2024 | 04/19/2024 | ACVF | SKX | SKECHERS USA INC-CL A | 0.13 | 104,696 | 830566105 | US8305661055 | BBG000C4HKK2 | 2428042 | 1,856 |

| 04/19/2024 | 04/19/2024 | ACVF | EW | EDWARDS LIFESCIENCES CORP | 0.13 | 102,870 | 2.82E+112 | US28176E1082 | BBG000BRXP69 | 2567116 | 1,197 |

| 04/19/2024 | 04/19/2024 | ACVF | FIS | FIDELITY NATIONAL INFO SERV | 0.13 | 102,275 | 31620M106 | US31620M1062 | BBG000BK2F42 | 2769796 | 1,446 |

| 04/19/2024 | 04/19/2024 | ACVF | TDG | TRANSDIGM GROUP INC | 0.13 | 102,142 | 893641100 | US8936411003 | BBG000L8CBX4 | B11FJK3 | 86 |

| 04/19/2024 | 04/19/2024 | ACVF | PAYX | PAYCHEX INC | 0.13 | 102,070 | 704326107 | US7043261079 | BBG000BQSQ38 | 2674458 | 854 |

| 04/19/2024 | 04/19/2024 | ACVF | PINS | PINTEREST INC- CLASS A | 0.13 | 101,444 | 72352L106 | US72352L1061 | BBG002583CV8 | BJ2Z0H2 | 3,131 |

| 04/19/2024 | 04/19/2024 | ACVF | NWSA | NEWS CORP - CLASS A | 0.12 | 100,283 | 65249B109 | US65249B1098 | BBG0035LY913 | BBGVT40 | 4,175 |

| 04/19/2024 | 04/19/2024 | ACVF | DHI | DR HORTON INC | 0.12 | 97,257 | 23331A109 | US23331A1097 | BBG000DQTXY6 | 2250687 | 684 |

| 04/19/2024 | 04/19/2024 | ACVF | NWS | NEWS CORP - CLASS B | 0.12 | 94,461 | 65249B208 | US65249B2088 | BBG0035M2ZB7 | BBGVT51 | 3,812 |

| 04/19/2024 | 04/19/2024 | ACVF | CTVA | CORTEVA INC-W/I | 0.12 | 93,598 | 22052L104 | US22052L1044 | BBG00BN969C1 | BK73B42 | 1,708 |

| 04/19/2024 | 04/19/2024 | ACVF | LAD | Lithia Motors Inc | 0.12 | 92,655 | 536797103 | US5367971034 | BBG000K3BC83 | 2515030 | 355 |

| 04/19/2024 | 04/19/2024 | ACVF | FOXA | FOX CORP - CLASS A | 0.11 | 90,874 | 35137L105 | US35137L1052 | BBG00JHNJW99 | BJJMGL2 | 2,895 |

| 04/19/2024 | 04/19/2024 | ACVF | MGM | MGM Resorts International | 0.11 | 90,566 | 552953101 | US5529531015 | BBG000C2BXK4 | 2547419 | 2,135 |

| 04/19/2024 | 04/19/2024 | ACVF | DXCM | DEXCOM INC | 0.11 | 89,928 | 252131107 | US2521311074 | BBG000QTF8K1 | B0796X4 | 688 |

| 04/19/2024 | 04/19/2024 | ACVF | CCI | CROWN CASTLE INTL CORP | 0.11 | 89,583 | 22822V101 | US22822V1017 | BBG000FV1Z23 | BTGQCX1 | 941 |

| 04/19/2024 | 04/19/2024 | ACVF | CBRE | CBRE GROUP INC - A | 0.11 | 86,852 | 12504L109 | US12504L1098 | BBG000C04224 | B6WVMH3 | 1,023 |

| 04/19/2024 | 04/19/2024 | ACVF | FAST | FASTENAL CO | 0.11 | 86,557 | 311900104 | US3119001044 | BBG000BJ8YN7 | 2332262 | 1,281 |

| 04/19/2024 | 04/19/2024 | ACVF | FITB | FIFTH THIRD BANCORP | 0.11 | 86,528 | 316773100 | US3167731005 | BBG000BJL3N0 | 2336747 | 2,387 |

| 04/19/2024 | 04/19/2024 | ACVF | ADM | ARCHER-DANIELS-MIDLAND CO | 0.10 | 83,070 | 39483102 | US0394831020 | BBG000BB6WG8 | 2047317 | 1,327 |

| 04/19/2024 | 04/19/2024 | ACVF | GWW | WW GRAINGER INC | 0.10 | 82,010 | 384802104 | US3848021040 | BBG000BKR1D6 | 2380863 | 87 |

| 04/19/2024 | 04/19/2024 | ACVF | DLR | DIGITAL REALTY TRUST INC | 0.10 | 81,824 | 253868103 | US2538681030 | BBG000Q5ZRM7 | B03GQS4 | 598 |

| 04/19/2024 | 04/19/2024 | ACVF | GEV-W | GE VERNOVA LLC | 0.10 | 80,654 | 36828A101 | US36828A1016 | BP6H4Y1 | 597 | |

| 04/19/2024 | 04/19/2024 | ACVF | FOX | FOX CORP- CLASS B | 0.10 | 78,901 | 35137L204 | US35137L2043 | BBG00JHNKJY8 | BJJMGY5 | 2,733 |

| 04/19/2024 | 04/19/2024 | ACVF | WELL | WELLTOWER INC | 0.10 | 77,987 | 95040Q104 | US95040Q1040 | BBG000BKY1G5 | BYVYHH4 | 854 |

| 04/19/2024 | 04/19/2024 | ACVF | IQV | IQVIA HOLDINGS INC COMMON STOCK USD.01 | 0.10 | 77,778 | 46266C105 | US46266C1053 | BBG00333FYS2 | BDR73G1 | 341 |

| 04/19/2024 | 04/19/2024 | ACVF | HCA | HCA HEALTHCARE INC | 0.10 | 77,192 | 40412C101 | US40412C1018 | BBG000QW7VC1 | B4MGBG6 | 253 |

| 04/19/2024 | 04/19/2024 | ACVF | LEN | LENNAR CORP-A | 0.10 | 76,596 | 526057104 | US5260571048 | BBG000BN5HF7 | 2511920 | 510 |

| 04/19/2024 | 04/19/2024 | ACVF | KMB | Kimberly-Clark Corp | 0.09 | 75,717 | 494368103 | US4943681035 | BBG000BMW2Z0 | 2491839 | 597 |

| 04/19/2024 | 04/19/2024 | ACVF | STT | STATE STREET CORP | 0.09 | 75,057 | 857477103 | US8574771031 | BBG000BKFBD7 | 2842040 | 1,023 |

| 04/19/2024 | 04/19/2024 | ACVF | KMI | KINDER MORGAN INC | 0.09 | 73,852 | 49456B101 | US49456B1017 | BBG0019JZ882 | B3NQ4P8 | 3,920 |

| 04/19/2024 | 04/19/2024 | ACVF | KSS | Kohls Corp | 0.09 | 73,512 | 500255104 | US5002551043 | BBG000CS7CT9 | 2496113 | 3,170 |

| 04/19/2024 | 04/19/2024 | ACVF | RKT US | ROCKET COS INC CLASS A COMMON STOCK USD.00001 | 0.09 | 73,408 | 77311W101 | US77311W1018 | BBG00VY1MYW7 | BMD6Y84 | 6,285 |

| 04/19/2024 | 04/19/2024 | ACVF | ODFL | Old Dominion Freight Line Inc. | 0.09 | 73,289 | 679580100 | US6795801009 | BBG000CHSS88 | 2656423 | 346 |

| 04/19/2024 | 04/19/2024 | ACVF | GIS | GENERAL MILLS INC | 0.09 | 72,250 | 370334104 | US3703341046 | BBG000BKCFC2 | 2367026 | 1,026 |

| 04/19/2024 | 04/19/2024 | ACVF | GD | GENERAL DYNAMICS CORP | 0.09 | 72,155 | 369550108 | US3695501086 | BBG000BK67C7 | 2365161 | 250 |

| 04/19/2024 | 04/19/2024 | ACVF | EBAY | EBAY INC | 0.09 | 72,108 | 278642103 | US2786421030 | BBG000C43RR5 | 2293819 | 1,431 |

| 04/19/2024 | 04/19/2024 | ACVF | CNC | CENTENE CORP | 0.09 | 70,265 | 15135B101 | US15135B1017 | BBG000BDXCJ5 | 2807061 | 935 |

| 04/19/2024 | 04/19/2024 | ACVF | GPC | GENUINE PARTS CO | 0.09 | 69,827 | 372460105 | US3724601055 | BBG000BKL348 | 2367480 | 430 |

| 04/19/2024 | 04/19/2024 | ACVF | MCHP | MICROCHIP TECHNOLOGY INC | 0.09 | 69,754 | 595017104 | US5950171042 | BBG000BHCP19 | 2592174 | 854 |

| 04/19/2024 | 04/19/2024 | ACVF | LYV | LIVE NATION ENTERTAINMENT IN | 0.09 | 69,089 | 538034109 | US5380341090 | BBG000FQ7YR4 | B0T7YX2 | 768 |

| 04/19/2024 | 04/19/2024 | ACVF | ETSY | ETSY INC | 0.09 | 68,562 | 29786A106 | US29786A1060 | BBG000N7MXL8 | BWTN5N1 | 1,027 |

| 04/19/2024 | 04/19/2024 | ACVF | WTW | WTW | 0.09 | 68,510 | G96629103 | IE00BDB6Q211 | BBG000DB3KT1 | BDB6Q21 | 259 |

| 04/19/2024 | 04/19/2024 | ACVF | PPG | PPG INDUSTRIES INC | 0.08 | 67,151 | 693506107 | US6935061076 | BBG000BRJ809 | 2698470 | 513 |

| 04/19/2024 | 04/19/2024 | ACVF | HAL | HALLIBURTON CO | 0.08 | 66,475 | 406216101 | US4062161017 | BBG000BKTFN2 | 2405302 | 1,701 |

| 04/19/2024 | 04/19/2024 | ACVF | GEHC | GE HEALTHCARE TECHNOLOG-W/I | 0.08 | 65,986 | 36266G107 | US36266G1076 | BBG01BFR8YV1 | BL6JPG8 | 781 |

| 04/19/2024 | 04/19/2024 | ACVF | TSCO | TRACTOR SUPPLY COMPANY | 0.08 | 65,472 | 892356106 | US8923561067 | BBG000BLXZN1 | 2900335 | 259 |

| 04/19/2024 | 04/19/2024 | ACVF | TROW | T ROWE PRICE GROUP INC | 0.08 | 65,129 | 74144T108 | US74144T1088 | BBG000BVMPN3 | 2702337 | 599 |

| 04/19/2024 | 04/19/2024 | ACVF | GILD | GILEAD SCIENCES INC | 0.08 | 63,355 | 375558103 | US3755581036 | BBG000CKGBP2 | 2369174 | 949 |

| 04/19/2024 | 04/19/2024 | ACVF | RJF | RAYMOND JAMES | 0.08 | 63,406 | 754730109 | US7547301090 | BBG000BS73J1 | 2718992 | 513 |

| 04/19/2024 | 04/19/2024 | ACVF | NEM | NEWMONT GOLDCORP CORPORATION COM | 0.08 | 63,173 | 651639106 | US6516391066 | BBG000BPWXK1 | 2636607 | 1,619 |

| 04/19/2024 | 04/19/2024 | ACVF | AAL | AMERICAN AIRLINES GROUP INC | 0.08 | 62,507 | 02376R102 | US02376R1023 | BBG005P7Q881 | BCV7KT2 | 4,430 |

| 04/19/2024 | 04/19/2024 | ACVF | WMB | Williams Companies Inc. | 0.08 | 62,270 | 969457100 | US9694571004 | BBG000BWVCP8 | 2967181 | 1,617 |

| 04/19/2024 | 04/19/2024 | ACVF | CEG | CONSTELLATION ENERGY CORP WHEN ISS | 0.08 | 62,048 | 21037T109 | US21037T1097 | BBG014KFRNP7 | BMH4FS1 | 343 |

| 04/19/2024 | 04/19/2024 | ACVF | MMM | 3M CO | 0.08 | 61,913 | 88579Y101 | US88579Y1010 | BBG000BP52R2 | 2595708 | 671 |

| 04/19/2024 | 04/19/2024 | ACVF | EL | ESTEE LAUDER | 0.08 | 61,807 | 518439104 | US5184391044 | BBG000FKJRC5 | 2320524 | 428 |

| 04/19/2024 | 04/19/2024 | ACVF | PEG | PUBLIC SERVICE ENTERPRISE GP | 0.08 | 61,664 | 744573106 | US7445731067 | BBG000BQZMH4 | 2707677 | 938 |

| 04/19/2024 | 04/19/2024 | ACVF | KHC | KRAFT HEINZ CO/THE | 0.08 | 61,279 | 500754106 | US5007541064 | BBG005CPNTQ2 | BYRY499 | 1,622 |

| 04/19/2024 | 04/19/2024 | ACVF | CDW | CDW CORP/DE | 0.08 | 61,067 | 12514G108 | US12514G1085 | BBG001P63B80 | BBM5MD6 | 259 |

| 04/19/2024 | 04/19/2024 | ACVF | OKE | ONEOK INC | 0.08 | 60,837 | 682680103 | US6826801036 | BBG000BQHGR6 | 2130109 | 764 |

| 04/19/2024 | 04/19/2024 | ACVF | IR | INGERSOLL RAND INC | 0.08 | 60,465 | 45687V106 | US45687V1061 | BBG002R1CW27 | BL5GZ82 | 684 |

| 04/19/2024 | 04/19/2024 | ACVF | AME | AMETEK INC | 0.07 | 60,240 | 31100100 | US0311001004 | BBG000B9XG87 | 2089212 | 339 |

| 04/19/2024 | 04/19/2024 | ACVF | SPG | SIMON PROPERTY GROUP INC | 0.07 | 59,546 | 828806109 | US8288061091 | BBG000BJ2D31 | 2812452 | 424 |

| 04/19/2024 | 04/19/2024 | ACVF | HIG | HARTFORD FINANCIAL SVCS GRP | 0.07 | 59,271 | 416515104 | US4165151048 | BBG000G0Z878 | 2476193 | 599 |

| 04/19/2024 | 04/19/2024 | ACVF | BKR | Baker Hughes Company | 0.07 | 58,288 | 05722G100 | US05722G1004 | BBG00GBVBK51 | BDHLTQ5 | 1,788 |

| 04/19/2024 | 04/19/2024 | ACVF | VLTO | VERALTO CORP-W/I | 0.07 | 58,134 | 92338C103 | US92338C1036 | BBG019Q32XJ9 | BPGMZQ5 | 654 |

| 04/19/2024 | 04/19/2024 | ACVF | RF | REGIONS FINANCIAL CORP | 0.07 | 57,947 | 7591EP100 | US7591EP1005 | BBG000Q3JN03 | B01R311 | 3,066 |

| 04/19/2024 | 04/19/2024 | ACVF | A | AGILENT TECHNOLOGIES INC | 0.07 | 56,808 | 00846U101 | US00846U1016 | BBG000C2V3D6 | 2520153 | 428 |

| 04/19/2024 | 04/19/2024 | ACVF | XEL | XCEL ENERGY INC | 0.07 | 56,033 | 98389B100 | US98389B1008 | BBG000BCTQ65 | 2614807 | 1,024 |

| 04/19/2024 | 04/19/2024 | ACVF | EFX | EQUIFAX INC | 0.07 | 55,563 | 294429105 | US2944291051 | BBG000BHPL78 | 2319146 | 257 |

| 04/19/2024 | 04/19/2024 | ACVF | BALL | BALL CORP | 0.07 | 55,467 | 58498106 | US0584981064 | BBG000BDDNH5 | 2073022 | 854 |

| 04/19/2024 | 04/19/2024 | ACVF | NTRS | NORTHERN TRUST CORP | 0.07 | 55,467 | 665859104 | US6658591044 | BBG000BQ74K1 | 2648668 | 681 |

| 04/19/2024 | 04/19/2024 | ACVF | RCL | ROYAL CARIBBEAN CRUISES LTD | 0.07 | 55,301 | V7780T103 | LR0008862868 | BBG000BB5792 | 2754907 | 428 |

| 04/19/2024 | 04/19/2024 | ACVF | CAH | CARDINAL HEALTH INC | 0.07 | 54,852 | 14149Y108 | US14149Y1082 | BBG000D898T9 | 2175672 | 507 |

| 04/19/2024 | 04/19/2024 | ACVF | DRI | DARDEN RESTAURANTS INC | 0.07 | 52,612 | 237194105 | US2371941053 | BBG000BBNYF6 | 2289874 | 345 |

| 04/19/2024 | 04/19/2024 | ACVF | DLTR | DOLLAR TREE INC | 0.06 | 51,618 | 256746108 | US2567461080 | BBG000BSC0K9 | 2272476 | 423 |

| 04/19/2024 | 04/19/2024 | ACVF | LYB | LYONDELLBASELL INDUSTRIES NV COMMON STOCK USD 0.04 | 0.06 | 51,276 | N53745100 | NL0009434992 | BBG000WCFV84 | B3SPXZ3 | 509 |

| 04/19/2024 | 04/19/2024 | ACVF | GLW | CORNING INC | 0.06 | 50,751 | 219350105 | US2193501051 | BBG000BKFZM4 | 2224701 | 1,623 |

| 04/19/2024 | 04/19/2024 | ACVF | CARR | CARRIER GLOBAL CORP-W/I | 0.06 | 50,211 | 14448C104 | US14448C1045 | BBG00RP5HYS8 | BK4N0D7 | 938 |

| 04/19/2024 | 04/19/2024 | ACVF | LUV | SOUTHWEST AIRLINES CO | 0.06 | 50,122 | 844741108 | US8447411088 | BBG000BNJHS8 | 2831543 | 1,706 |

| 04/19/2024 | 04/19/2024 | ACVF | BR | Broadridge Financial Solutions, Inc. | 0.06 | 49,892 | 11133T103 | US11133T1034 | BBG000PPFKQ7 | B1VP7R6 | 258 |

| 04/19/2024 | 04/19/2024 | ACVF | KEYS | KEYSIGHT TEC | 0.06 | 49,631 | 49338L103 | US49338L1035 | BBG0059FN811 | BQZJ0Q9 | 342 |

| 04/19/2024 | 04/19/2024 | ACVF | CFG | CITIZENS FINANCIAL GROUP | 0.06 | 49,183 | 174610105 | US1746101054 | BBG006Q0HY77 | BQRX1X3 | 1,447 |

| 04/19/2024 | 04/19/2024 | ACVF | WAB | WABTEC CORP | 0.06 | 48,873 | 929740108 | US9297401088 | BBG000BDD940 | 2955733 | 339 |

| 04/19/2024 | 04/19/2024 | ACVF | OTIS | OTIS WORLDWIDE CORP-W/I | 0.06 | 48,315 | 68902V107 | US68902V1070 | BBG00RP60KV0 | BK531S8 | 508 |

| 04/19/2024 | 04/19/2024 | ACVF | HSY | HERSHEY CO/THE | 0.06 | 47,920 | 427866108 | US4278661081 | BBG000BLHRS2 | 2422806 | 259 |

| 04/19/2024 | 04/19/2024 | ACVF | FTV | FORTIVE CORP | 0.06 | 47,773 | 34959J108 | US34959J1088 | BBG00BLVZ228 | BYT3MK1 | 601 |

| 04/19/2024 | 04/19/2024 | ACVF | AVB | AVALONBAY COMMUNITIES INC | 0.06 | 47,689 | 53484101 | US0534841012 | BBG000BLPBL5 | 2131179 | 259 |

| 04/19/2024 | 04/19/2024 | ACVF | APTV | APTIV PLC COMMON STOCK USD.01 | 0.06 | 47,557 | G6095L109 | JE00B783TY65 | BBG001QD41M9 | B783TY6 | 683 |

| 04/19/2024 | 04/19/2024 | ACVF | EQR | EQUITY RESIDENTIAL | 0.06 | 47,324 | 29476L107 | US29476L1070 | BBG000BG8M31 | 2319157 | 769 |

| 04/19/2024 | 04/19/2024 | ACVF | EIX | EDISON INTERNATIONAL | 0.06 | 47,062 | 281020107 | US2810201077 | BBG000D7RKJ5 | 2829515 | 673 |

| 04/19/2024 | 04/19/2024 | ACVF | BK | BANK OF NEW YORK MELLON CORP | 0.06 | 46,608 | 64058100 | US0640581007 | BBG000BD8PN9 | B1Z77F6 | 828 |

| 04/19/2024 | 04/19/2024 | ACVF | LVS | LAS VEGAS SANDS CORP | 0.06 | 46,596 | 517834107 | US5178341070 | BBG000JWD753 | B02T2J7 | 1,025 |

| 04/19/2024 | 04/19/2024 | ACVF | PXD | PIONEER NATURAL RESOURCES CO | 0.06 | 46,223 | 723787107 | US7237871071 | BBG000BXRPH1 | 2690830 | 171 |

| 04/19/2024 | 04/19/2024 | ACVF | BBY | BEST BUY CO INC | 0.06 | 45,537 | 86516101 | US0865161014 | BBG000BCWCG1 | 2094670 | 598 |

| 04/19/2024 | 04/19/2024 | ACVF | UA | UNDER ARMOUR INC-CLASS C | 0.06 | 45,108 | 904311206 | US9043112062 | BBG009DTD8H2 | BDF9YM2 | 6,972 |

| 04/19/2024 | 04/19/2024 | ACVF | MSCI | MSCI INC | 0.06 | 44,886 | 55354G100 | US55354G1004 | BBG000RTDY25 | B2972D2 | 88 |

| 04/19/2024 | 04/19/2024 | ACVF | AIG | AMERICAN INTERNATIONAL GROUP | 0.06 | 44,686 | 26874784 | US0268747849 | BBG000BBDZG3 | 2027342 | 602 |

| 04/19/2024 | 04/19/2024 | ACVF | CHD | CHURCH & DWIGHT CO INC | 0.06 | 44,661 | 171340102 | US1713401024 | BBG000BFJT36 | 2195841 | 428 |

| 04/19/2024 | 04/19/2024 | ACVF | NSC | NORFOLK SOUTHERN CORP | 0.06 | 44,636 | 655844108 | US6558441084 | BBG000BQ5DS5 | 2641894 | 185 |

| 04/19/2024 | 04/19/2024 | ACVF | DD | DUPONT DE NEMOURS INC | 0.05 | 42,782 | 26614N102 | US26614N1028 | BBG00BN961G4 | BK0VN47 | 579 |

| 04/19/2024 | 04/19/2024 | ACVF | WY | WEYERHAEUSER CO | 0.05 | 42,830 | 962166104 | US9621661043 | BBG000BX3BL3 | 2958936 | 1,361 |

| 04/19/2024 | 04/19/2024 | ACVF | AFL | AFLAC INC | 0.05 | 42,613 | 1055102 | US0010551028 | BBG000BBBNC6 | 2026361 | 512 |

| 04/19/2024 | 04/19/2024 | ACVF | FE | FIRSTENERGY CORP | 0.05 | 42,406 | 337932107 | US3379321074 | BBG000BB6M98 | 2100920 | 1,111 |

| 04/19/2024 | 04/19/2024 | ACVF | IP | INTERNATIONAL PAPER CO | 0.05 | 42,267 | 460146103 | US4601461035 | BBG000BM5SR2 | 2465254 | 1,195 |

| 04/19/2024 | 04/19/2024 | ACVF | WEC | WEC ENERGY GROUP INC | 0.05 | 42,084 | 92939U106 | US92939U1060 | BBG000BWP7D9 | BYY8XK8 | 516 |

| 04/19/2024 | 04/19/2024 | ACVF | IDXX | IDEXX LABS | 0.05 | 41,918 | 45168D104 | US45168D1046 | BBG000BLRT07 | 2459202 | 88 |

| 04/19/2024 | 04/19/2024 | ACVF | CINF | CINCINNATI FINANCIAL CORP | 0.05 | 41,382 | 172062101 | US1720621010 | BBG000BFPK65 | 2196888 | 345 |

| 04/19/2024 | 04/19/2024 | ACVF | UAA | UNDER ARMOUR INC-CLASS A | 0.05 | 41,302 | 904311107 | US9043111072 | BBG000BXM6V2 | B0PZN11 | 6,137 |

| 04/19/2024 | 04/19/2024 | ACVF | ALL | ALLSTATE CORP | 0.05 | 40,991 | 20002101 | US0200021014 | BBG000BVMGF2 | 2019952 | 237 |

| 04/19/2024 | 04/19/2024 | ACVF | AJG | ARTHUR J GALLAGHER & CO | 0.05 | 40,926 | 363576109 | US3635761097 | BBG000BBHXQ3 | 2359506 | 173 |

| 04/19/2024 | 04/19/2024 | ACVF | ES | EVERSOURCE ENERGY | 0.05 | 40,768 | 30040W108 | US30040W1080 | BBG000BQ87N0 | BVVN4Q8 | 683 |

| 04/19/2024 | 04/19/2024 | ACVF | DPZ | Dominos Pizza INC | 0.05 | 40,725 | 25754A201 | US25754A2015 | BBG000P458P3 | B01SD70 | 86 |

| 04/19/2024 | 04/19/2024 | ACVF | WBA | WALGREENS BOOTS ALLIANCE INC | 0.05 | 40,456 | 931427108 | US9314271084 | BBG000BWLMJ4 | BTN1Y44 | 2,218 |

| 04/19/2024 | 04/19/2024 | ACVF | ILMN | ILLUMINA INC | 0.05 | 40,161 | 452327109 | US4523271090 | BBG000DSMS70 | 2613990 | 342 |

| 04/19/2024 | 04/19/2024 | ACVF | HES | HESS CORP | 0.05 | 39,513 | 42809H107 | US42809H1077 | BBG000BBD070 | 2023748 | 256 |

| 04/19/2024 | 04/19/2024 | ACVF | EXPD | EXPEDITORS INTL WASH INC | 0.05 | 39,425 | 302130109 | US3021301094 | BBG000BJ5GK2 | 2325507 | 344 |

| 04/19/2024 | 04/19/2024 | ACVF | DOW | DOW INC | 0.05 | 38,472 | 260557103 | US2605571031 | BBG00BN96922 | BHXCF84 | 679 |

| 04/19/2024 | 04/19/2024 | ACVF | PRU | PRUDENTIAL FINANCIAL INC | 0.05 | 38,271 | 744320102 | US7443201022 | BBG000HCJMF9 | 2819118 | 346 |

| 04/19/2024 | 04/19/2024 | ACVF | TRV | The Travelers Companies Inc. | 0.05 | 38,318 | 8.94E+113 | US89417E1091 | BBG000BJ81C1 | 2769503 | 179 |

| 04/19/2024 | 04/19/2024 | ACVF | DTE | DTE ENERGY COMPANY | 0.05 | 37,565 | 233331107 | US2333311072 | BBG000BB29X4 | 2280220 | 346 |

| 04/19/2024 | 04/19/2024 | ACVF | YUM | YUM! BRANDS INC | 0.05 | 36,979 | 988498101 | US9884981013 | BBG000BH3GZ2 | 2098876 | 267 |

| 04/19/2024 | 04/19/2024 | ACVF | J | JACOBS SOLUTIONS INC COMMON STOCK | 0.05 | 36,532 | 46982L108 | US46982L1089 | BBG019C1BQR4 | BNGC0D3 | 254 |

| 04/19/2024 | 04/19/2024 | ACVF | ULTA | Ulta Beauty Inc. | 0.04 | 35,561 | 90384S303 | US90384S3031 | BBG00FWQ4VD6 | B28TS42 | 86 |

| 04/19/2024 | 04/19/2024 | ACVF | HBAN | HUNTINGTON BANCSHARES INC | 0.04 | 35,112 | 446150104 | US4461501045 | BBG000BKWSR6 | 2445966 | 2,644 |

| 04/19/2024 | 04/19/2024 | ACVF | LH | Laboratory Corp. of America Holdings | 0.04 | 34,654 | 50540R409 | US50540R4092 | BBG000D9DMK0 | 2586122 | 172 |

| 04/19/2024 | 04/19/2024 | ACVF | STX | SEAGATE TECHNOLOGY-ORDINARY SHARES | 0.04 | 34,633 | G7997R103 | IE00BKVD2N49 | BBG0113JGQF0 | BKVD2N4 | 420 |

| 04/19/2024 | 04/19/2024 | ACVF | AMCR | AMCOR PLC | 0.04 | 34,417 | G0250X107 | JE00BJ1F3079 | BBG00LNJRQ09 | BJ1F307 | 3,837 |

| 04/19/2024 | 04/19/2024 | ACVF | KR | KROGER CO | 0.04 | 33,772 | 501044101 | US5010441013 | BBG000BMY992 | 2497406 | 597 |

| 04/19/2024 | 04/19/2024 | ACVF | BBWI | Bath & Body Works Inc | 0.04 | 33,080 | 70830104 | US0708301041 | BBG000BNGTQ7 | BNNTGJ5 | 752 |

| 04/19/2024 | 04/19/2024 | ACVF | TYL | TYLER TECHNOLOGIES INC | 0.04 | 32,671 | 902252105 | US9022521051 | BBG000BVWZF9 | 2909644 | 81 |

| 04/19/2024 | 04/19/2024 | ACVF | VEEV | VEEVA SYSTEMS INC-CLASS A | 0.04 | 32,534 | 922475108 | US9224751084 | BBG001CGB489 | BFH3N85 | 164 |

| 04/19/2024 | 04/19/2024 | ACVF | ZBH | ZIMMER BIOMET HOLDINGS INC | 0.04 | 31,768 | 98956P102 | US98956P1021 | BBG000BKPL53 | 2783815 | 266 |

| 04/19/2024 | 04/19/2024 | ACVF | L | LOEWS CORP | 0.04 | 31,617 | 540424108 | US5404241086 | BBG000C45984 | 2523022 | 418 |

| 04/19/2024 | 04/19/2024 | ACVF | COO | COOPER COS INC | 0.04 | 31,104 | 216648501 | US2166485019 | BQPDXR3 | 344 | |

| 04/19/2024 | 04/19/2024 | ACVF | EXC | EXELON CORP | 0.04 | 31,166 | 30161N101 | US30161N1019 | BBG000J6XT05 | 2670519 | 830 |

| 04/19/2024 | 04/19/2024 | ACVF | PKG | Packaging Corp. of America | 0.04 | 31,120 | 695156109 | US6951561090 | BBG000BB8SW7 | 2504566 | 173 |

| 04/19/2024 | 04/19/2024 | ACVF | SYY | SYSCO CORP | 0.04 | 31,152 | 871829107 | US8718291078 | BBG000BTVJ25 | 2868165 | 406 |

| 04/19/2024 | 04/19/2024 | ACVF | POOL | POOL CORP | 0.04 | 31,057 | 73278L105 | US73278L1052 | BBG000BCVG28 | 2781585 | 86 |

| 04/19/2024 | 04/19/2024 | ACVF | RMD | RESMED INC | 0.04 | 30,941 | 761152107 | US7611521078 | BBG000L4M7F1 | 2732903 | 173 |

| 04/19/2024 | 04/19/2024 | ACVF | UAL | UNITED AIRLINES HOLDINGS INC | 0.04 | 30,673 | 910047109 | US9100471096 | BBG000M65M61 | B4QG225 | 597 |

| 04/19/2024 | 04/19/2024 | ACVF | AEP | AMERICAN ELECTRIC POWER | 0.04 | 29,470 | 25537101 | US0255371017 | BBG000BB9KF2 | 2026242 | 350 |

| 04/19/2024 | 04/19/2024 | ACVF | PFG | PRINCIPAL FINANCIAL GROUP | 0.03 | 27,590 | 74251V102 | US74251V1026 | BBG000NSCNT7 | 2803014 | 343 |

| 04/19/2024 | 04/19/2024 | ACVF | PHM | PULTEGROUP INC | 0.03 | 27,306 | 745867101 | US7458671010 | BBG000BR54L0 | 2708841 | 259 |

| 04/19/2024 | 04/19/2024 | ACVF | KEY | KEYCORP | 0.03 | 26,202 | 493267108 | US4932671088 | BBG000BMQPL1 | 2490911 | 1,791 |

| 04/19/2024 | 04/19/2024 | ACVF | SRE | SEMPRA ENERGY | 0.03 | 25,929 | 816851109 | US8168511090 | BBG000C2ZCH8 | 2138158 | 370 |

| 04/19/2024 | 04/19/2024 | ACVF | BF/B | BROWN-FORMAN CORP | 0.03 | 25,560 | 115637209 | US1156372096 | BBG000BD2NY8 | 2146838 | 521 |

| 04/19/2024 | 04/19/2024 | ACVF | MKC | MCCORMICK-N/V | 0.03 | 25,280 | 579780206 | US5797802064 | BBG000G6Y5W4 | 2550161 | 342 |

| 04/19/2024 | 04/19/2024 | ACVF | BWA | BORGWARNER INC | 0.03 | 25,059 | 99724106 | US0997241064 | BBG000BJ49H3 | 2111955 | 764 |

| 04/19/2024 | 04/19/2024 | ACVF | LKQ | LKQ CORP | 0.03 | 25,051 | 501889208 | US5018892084 | BBG000PXDL44 | 2971029 | 510 |

| 04/19/2024 | 04/19/2024 | ACVF | D | DOMINION RESOURCES INC/VA | 0.03 | 24,471 | 25746U109 | US25746U1097 | BBG000BGVW60 | 2542049 | 491 |

| 04/19/2024 | 04/19/2024 | ACVF | CNP | CENTERPOINT ENERGY INC | 0.03 | 24,307 | 15189T107 | US15189T1079 | BBG000FDBX90 | 2440637 | 852 |

| 04/19/2024 | 04/19/2024 | ACVF | WYNN | WYNN RESORTS LTD | 0.03 | 24,127 | 983134107 | US9831341071 | BBG000LD9JQ8 | 2963811 | 254 |

| 04/19/2024 | 04/19/2024 | ACVF | ROK | ROCKWELL AUTOMATION INC | 0.03 | 23,216 | 773903109 | US7739031091 | BBG000BBCDZ2 | 2754060 | 86 |

| 04/19/2024 | 04/19/2024 | ACVF | XYL | Xylem Inc/NY | 0.03 | 22,116 | 98419M100 | US98419M1009 | BBG001D8R5D0 | B3P2CN8 | 173 |

| 04/19/2024 | 04/19/2024 | ACVF | O | REALTY INCOME CORP | 0.03 | 21,958 | 756109104 | US7561091049 | BBG000DHPN63 | 2724193 | 414 |

| 04/19/2024 | 04/19/2024 | ACVF | VTR | Ventas Inc. | 0.03 | 21,866 | 92276F100 | US92276F1003 | BBG000FRVHB9 | 2927925 | 507 |

| 04/19/2024 | 04/19/2024 | ACVF | VMC | VULCAN MATERIALS CO | 0.03 | 21,677 | 929160109 | US9291601097 | BBG000BWGYF8 | 2931205 | 86 |

| 04/19/2024 | 04/19/2024 | ACVF | MOS | MOSAIC CO/THE | 0.03 | 21,111 | 61945C103 | US61945C1036 | BBG000BFXHL6 | B3NPHP6 | 681 |

| 04/19/2024 | 04/19/2024 | ACVF | PWR | QUANTA SERVICES INC | 0.03 | 20,920 | 7.48E+106 | US74762E1029 | BBG000BBL8V7 | 2150204 | 86 |

| 04/19/2024 | 04/19/2024 | ACVF | TPR | TAPESTRY INC COMMON STOCK USD.01 | 0.03 | 20,878 | 876030107 | US8760301072 | BBG000BY29C7 | BF09HX3 | 514 |

| 04/19/2024 | 04/19/2024 | ACVF | BIIB | BIOGEN INC | 0.03 | 20,604 | 09062X103 | US09062X1037 | BBG000C17X76 | 2455965 | 106 |

| 04/19/2024 | 04/19/2024 | ACVF | AWK | AMERICAN WATER WORKS CO INC | 0.03 | 20,503 | 30420103 | US0304201033 | BBG000TRJ294 | B2R3PV1 | 173 |

| 04/19/2024 | 04/19/2024 | ACVF | WRK | WESTROCK CO | 0.03 | 20,539 | 96145D105 | US96145D1054 | BBG008NXC572 | BYR0914 | 428 |

| 04/19/2024 | 04/19/2024 | ACVF | ARE | Alexandria Real Estate Equitie | 0.02 | 20,014 | 15271109 | US0152711091 | BBG000BC33T9 | 2009210 | 173 |

| 04/19/2024 | 04/19/2024 | ACVF | HOLX | HOLOGIC INC | 0.02 | 19,297 | 436440101 | US4364401012 | BBG000C3NTN5 | 2433530 | 256 |

| 04/19/2024 | 04/19/2024 | ACVF | HST | HOST HOTELS & RESORTS INC | 0.02 | 19,009 | 44107P104 | US44107P1049 | BBG000BL8804 | 2567503 | 1,016 |

| 04/19/2024 | 04/19/2024 | ACVF | CHRW | C.H. ROBINSON WORLDWIDE INC | 0.02 | 18,588 | 12541W209 | US12541W2098 | BBG000BTCH57 | 2116228 | 261 |

| 04/19/2024 | 04/19/2024 | ACVF | PVH | PVH CORP | 0.02 | 18,259 | 693656100 | US6936561009 | BBG000BRRG02 | B3V9F12 | 171 |

| 04/19/2024 | 04/19/2024 | ACVF | MKTX | MarketAxess Holdings Inc. | 0.02 | 17,544 | 57060D108 | US57060D1081 | BBG000BJBZ23 | B03Q9D0 | 86 |

| 04/19/2024 | 04/19/2024 | ACVF | PAYC | PAYCOM SOFTWARE INC | 0.02 | 15,759 | 70432V102 | US70432V1026 | BBG0064N0ZZ5 | BL95MY0 | 86 |

| 04/19/2024 | 04/19/2024 | ACVF | SBAC | SBA COMMUNICATIONS CORP | 0.02 | 15,292 | 78410G104 | US78410G1040 | BBG000D2M0Z7 | BZ6TS23 | 78 |

| 04/19/2024 | 04/19/2024 | ACVF | IFF | INTERNATIONAL FLAVORS & FRAGRANCES | 0.02 | 14,358 | 459506101 | US4595061015 | BBG000BLSL58 | 2464165 | 171 |

| 04/19/2024 | 04/19/2024 | ACVF | JBHT | JB Hunt Transport Services, Inc. | 0.02 | 14,387 | 445658107 | US4456581077 | BBG000BMDBZ1 | 2445416 | 86 |

| 04/19/2024 | 04/19/2024 | ACVF | INCY | Incyte Corp. | 0.02 | 13,663 | 45337C102 | US45337C1027 | BBG000BNPSQ9 | 2471950 | 261 |

| 04/19/2024 | 04/19/2024 | ACVF | AAP | ADVANCE AUTO PARTS INC | 0.02 | 13,534 | 00751Y106 | US00751Y1064 | BBG000F7RCJ1 | 2822019 | 172 |

| 04/19/2024 | 04/19/2024 | ACVF | CE | Celanese Corp | 0.02 | 13,437 | 150870103 | US1508701034 | BBG000JYP7L8 | B05MZT4 | 87 |

| 04/19/2024 | 04/19/2024 | ACVF | RL | RALPH LAUREN CORP | 0.02 | 13,469 | 751212101 | US7512121010 | BBG000BS0ZF1 | B4V9661 | 85 |

| 04/19/2024 | 04/19/2024 | ACVF | BEN | FRANKLIN RESOURCES INC | 0.02 | 12,776 | 354613101 | US3546131018 | BBG000BD0TF8 | 2350684 | 508 |

| 04/19/2024 | 04/19/2024 | ACVF | EXR | EXTRA SPACE STORAGE INC | 0.01 | 11,524 | 30225T102 | US30225T1025 | BBG000PV27K3 | B02HWR9 | 87 |

| 04/19/2024 | 04/19/2024 | ACVF | CLX | CLOROX COMPANY | 0.01 | 11,340 | 189054109 | US1890541097 | BBG000BFS7D3 | 2204026 | 79 |

| 04/19/2024 | 04/19/2024 | ACVF | MAA | MID-AMERICA APARTMENT COMM | 0.01 | 10,968 | 59522J103 | US59522J1034 | BBG000BLMY92 | 2589132 | 87 |

| 04/19/2024 | 04/19/2024 | ACVF | SOLVw | SOLVENTUM CORP W/I COMMON STOCK | 0.01 | 10,387 | 83444M101 | US83444M1018 | BBG018YZH6T3 | BMTQB43 | 167 |

| 04/19/2024 | 04/19/2024 | ACVF | ALB | ALBEMARLE CORP | 0.01 | 9,644 | 12653101 | US0126531013 | BBG000BJ26K7 | 2046853 | 86 |

| 04/19/2024 | 04/19/2024 | ACVF | HAS | HASBRO INC | 0.01 | 9,616 | 418056107 | US4180561072 | BBG000BKVJK4 | 2414580 | 174 |

| 04/19/2024 | 04/19/2024 | ACVF | AES | LIBERTY MEDIA COR-SIRIUSXM A | 0.01 | 8,314 | 00130H105 | US00130H1059 | BBG000C23KJ3 | 2002479 | 507 |

| 04/19/2024 | 04/19/2024 | ACVF | ED | CONSOLIDATED EDISON INC | 0.01 | 7,708 | 209115104 | US2091151041 | BBG000BHLYS1 | 2216850 | 84 |

| 04/19/2024 | 04/19/2024 | ACVF | SYF | SYNCHRONY FINANCIAL | 0.01 | 7,191 | 87165B103 | US87165B1035 | BBG00658F3P3 | BP96PS6 | 173 |

| 04/19/2024 | 04/19/2024 | ACVF | FTRE | Fortrea Holdings Inc. | 0.01 | 6,106 | 34965K107 | US34965K1079 | BBG01GZF9VY6 | BRXYZ57 | 172 |

| 04/19/2024 | 04/19/2024 | ACVF | PHIN-W | PHINIA Inc. | 0.01 | 5,881 | 71880K101 | US71880K1016 | BBG01F6N6NM7 | BPW7PC0 | 157 |

| 04/19/2024 | 04/19/2024 | ACVF | AEE | AMEREN CORPORATION | 0.01 | 5,467 | 23608102 | US0236081024 | BBG000B9X8C0 | 2050832 | 74 |

| 04/19/2024 | 04/19/2024 | ACVF | SLVM | SYLVAMO CORP WHEN ISSUED | 0.01 | 5,495 | 871332102 | US8713321029 | BBG0122M8031 | BMW72C8 | 94 |

| 04/19/2024 | 04/19/2024 | ACVF | FMC | FMC CORP | 0.01 | 5,030 | 302491303 | US3024913036 | BBG000BJP882 | 2328603 | 87 |

| 04/19/2024 | 04/19/2024 | ACVF | IVZ | INVESCO LTD | 0.01 | 4,011 | G491BT108 | BMG491BT1088 | BBG000BY2Y78 | B28XP76 | 261 |

| 04/19/2024 | 04/19/2024 | ACVF | MTD | METTLER-TOLEDO | 0.00 | 1,188 | 592688105 | US5926881054 | BBG000BZCKH3 | 2126249 | 1 |

| 04/19/2024 | 04/19/2024 | ACVF | EMBC | EMBECTA CORP-W/I | 0.00 | 1,083 | 29082K105 | US29082K1051 | BBG014L7D4G1 | BMXWYR1 | 102 |