ETF Fund Data

FUND NAME:

TICKER:

LAUNCH DATE:

MANAGEMENT STYLE:

Active

CUSIP:

TOTAL GROSS EXPENSE RATIO:

ASSET CLASS:

EXCHANGE:

ADVISOR:

IPOV TICKER SYMBOL*:

AS OF DATE:

NAV ($)**

MARKET PRICE ($)***

PREMIUM / DISCOUNT (%)

30 DAY MEDIAN BID/ASK SPREAD****

SHARES OUTSTANDING

TOTAL NET ASSETS

NUMBER OF HOLDINGS

*IOPV, or Indicative Optimized Portfolio Value, is a calculation disseminated by the stock exchange that approximates the Fund’s NAV every fifteen seconds throughout the trading day.

**“Net asset value” or “NAV” is determined by adding up the value of all the assets in the fund, including assets and cash, subtracting any liabilities, and then dividing that value by the number of outstanding shares in the ETF.

***Market Price is defined as the official closing price of the ETF share.

****30-Day Median Bid/Ask Percentage Spread Calculation: Based on Rule 6c-11(c)(1)(v), to calculate the median bid-ask spread the fund, (i) identifies the ETF’s NBBO as of the end of each 10-second interval during each trading day of the last 30 calendar days; (ii) divides the difference between each such bid and offer by the midpoint of the NBBO; and (iii) identify the median of those values.

PREMIUM/DISCOUNT

| Number of Days at | Cal. Year 2024 | 1Q 2025 | 2Q 2025 | 3Q 2025 |

|---|---|---|---|---|

| Premium* | 169 | 40 | 8 | |

| Discount** | 83 | 20 | 53 | |

| TOTAL | 252 | 60 | 61 |

*Premium – The number of trading days the ETF’s closing price exceeds its NAV.

**Discount – The number of trading days the ETF’s closing price is below its NAV.

PERFORMANCE

(as of June 30, 2025)

| . | QTD | 6 MTH | YTD | 1 YR | 2 YR* | 3 YR* | INCEPTION (1)* |

|---|---|---|---|---|---|---|---|

| ACVF (Market) | 10.32% | 8.23% | 8.23% | 15.01% | 18.86% | 19.14% | 16.30% |

| ACVF (NAV) | 10.41% | 8.12% | 8.12% | 15.14% | 18.95% | 19.09% | 16.31% |

| SPTR Index | 10.94% | 6.20% | 6.20% | 15.16% | 19.71% | 19.66% | 16.44% |

| RUSSELL 1000 Index | 11.10% | 6.12% | 6.12% | 15.66% | 19.70% | 19.59% | 15.85% |

(1) Since Inception Returns are annualized and calculated using 10/28/20 NAV and Index Values. *Performance returns for periods greater than one year are annualized.

Performance is shown net of fees. The performance data quoted represents past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than their original cost and current performance may be lower or higher than the performance quoted. Performance current to the most recent month-end can be obtained by calling (888) 909-6030.

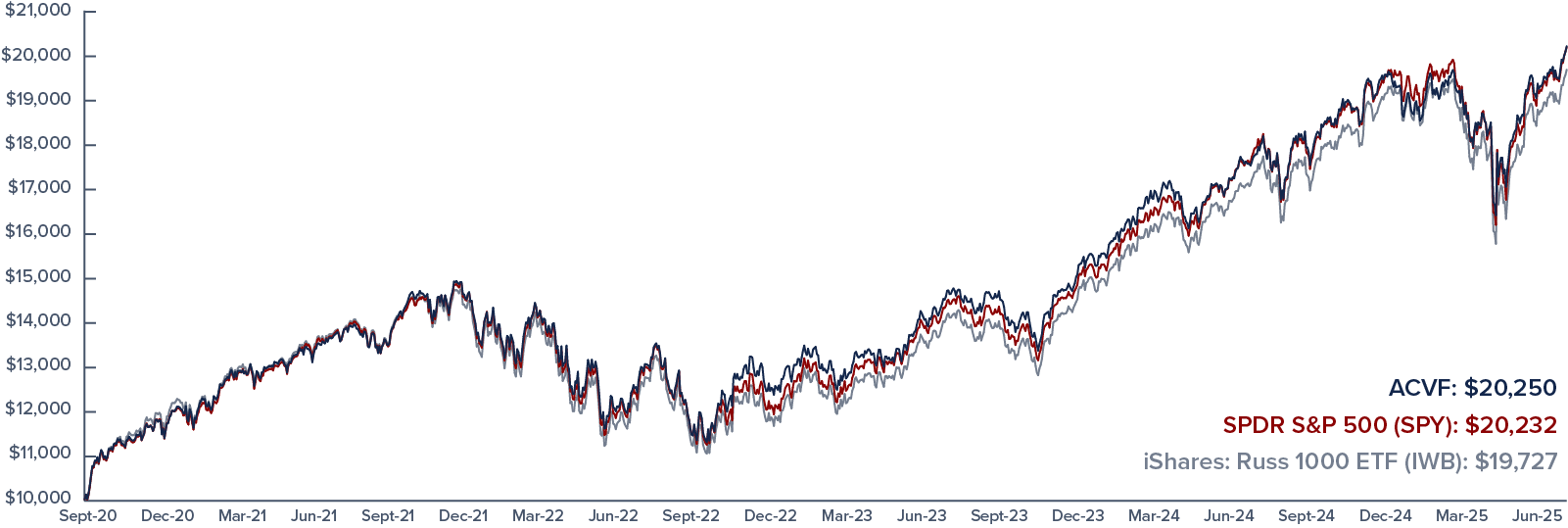

GROWTH of $10K vs comparable ETFS (2)

(as of June 30, 2025)

(2) Indexes are un-investable, due to the absence of fees. This comparison uses two widely used large-cap blend ETFs which track the benchmarks used in the performance table. The SPDR® S&P 500® ETF Trust (Ticker: SPY) seeks to provide investment results that correspond generally to the price and yield performance of the S&P 500® Index [SPY Standardized Performance ]. The iShares Russell 1000 ETF (Ticker: IWB) seeks to track the investment results of an index composed of large- and mid-capitalization U.S. equities. [IWB Standardized Performance]. ACVF is an actively managed ETF while SPY & IWB are passively managed index ETFs.

Portfolio Holdings

| Effective Date | Ticker | Holdins Name | Market Value % | Market Value $ | Security ID | Shares / Quantity |

|---|---|---|---|---|---|---|

| 07/08/2025 | NVDA | NVIDIA CORP | 7.54 | $9,740,000 | 67066G104 | 60,875 |

| 07/08/2025 | MSFT | MICROSOFT CORP | 6.28 | $8,121,723 | 594918104 | 16,354 |

| 07/08/2025 | AVGO | Broadcom Inc. | 2.62 | $3,380,920 | 11135F101 | 12,439 |

| 07/08/2025 | BRK B | BERKSHIRE HATHAWAY INC-CL B | 1.83 | $2,361,089 | 84670702 | 4,945 |

| 07/08/2025 | CSCO | CISCO SYSTEMS INC | 1.79 | $2,308,945 | 17275R102 | 33,663 |

| 07/08/2025 | MA | MASTERCARD INC - A | 1.78 | $2,298,692 | 57636Q104 | 4,087 |

| 07/08/2025 | WMT | WAL-MART STORES INC | 1.76 | $2,279,188 | 931142103 | 23,475 |

| 07/08/2025 | HD | HOME DEPOT INC | 1.54 | $1,989,278 | 437076102 | 5,413 |

| 07/08/2025 | ORCL | ORACLE CORP | 1.42 | $1,833,321 | 68389X105 | 7,818 |

| 07/08/2025 | PG | PROCTER & GAMBLE CO/THE | 1.40 | $1,813,682 | 742718109 | 11,487 |

| 07/08/2025 | LLY | ELI LILLY & CO | 1.38 | $1,784,730 | 532457108 | 2,295 |

| 07/08/2025 | XOM | EXXON MOBIL CORP | 1.33 | $1,724,155 | 30231G102 | 15,099 |

| 07/08/2025 | BKNG | BOOKING HOLDINGS INC | 1.04 | $1,342,633 | 09857L108 | 235 |

| 07/08/2025 | TMUS | T-MOBILE US INC | 0.99 | $1,283,677 | 872590104 | 5,440 |

| 07/08/2025 | INTU | INTUIT INC | 0.98 | $1,273,031 | 461202103 | 1,629 |

| 07/08/2025 | MCD | MCDONALDS CORP | 0.96 | $1,234,639 | 580135101 | 4,233 |

| 07/08/2025 | NOW | SERVICENOW INC | 0.90 | $1,159,036 | 81762P102 | 1,133 |

| 07/08/2025 | TJX | TJX COMPANIES INC | 0.88 | $1,138,739 | 872540109 | 9,091 |

| 07/08/2025 | LIN | LINDE PLC | 0.85 | $1,094,514 | G54950103 | 2,329 |

| 07/08/2025 | ABBV | ABBVIE INC | 0.83 | $1,071,441 | 00287Y109 | 5,646 |

| 07/08/2025 | PM | PHILIP MORRIS INTERNATIONAL | 0.80 | $1,035,219 | 718172109 | 5,825 |

| 07/08/2025 | WFC | WELLS FARGO & CO | 0.77 | $990,339 | 949746101 | 12,138 |

| 07/08/2025 | SO | THE SOUTHERN COMPANY | 0.76 | $976,026 | 842587107 | 10,695 |

| 07/08/2025 | T | AT&T INC | 0.74 | $955,664 | 00206R102 | 33,781 |

| 07/08/2025 | SPOT | SPOTIFY TECHNOLOGY SA | 0.73 | $937,086 | L8681T102 | 1,299 |

| 07/08/2025 | PEP | PEPSICO INC | 0.72 | $924,214 | 713448108 | 6,844 |

| 07/08/2025 | ANET | ARISTA NETWORKS INC | 0.71 | $914,381 | 40413205 | 8,844 |

| 07/08/2025 | VRSN | VERISIGN INC | 0.71 | $914,191 | 9.2343E+106 | 3,187 |

| 07/08/2025 | ACN | ACCENTURE PLC-CL A | 0.70 | $903,923 | G1151C101 | 2,980 |

| 07/08/2025 | CHTR | CHARTER COMMUNICATIONS INC-A | 0.68 | $883,011 | 16119P108 | 2,145 |

| 07/08/2025 | ADBE | ADOBE SYSTEMS INC | 0.68 | $882,592 | 00724F101 | 2,309 |

| 07/08/2025 | CVX | CHEVRON CORP | 0.68 | $881,436 | 166764100 | 5,752 |

| 07/08/2025 | MSI | MOTOROLA SOLUTIONS INC | 0.67 | $871,865 | 620076307 | 2,089 |

| 07/08/2025 | UBER | UBER TECHNOLOGIES INC | 0.67 | $871,471 | 90353T100 | 8,940 |

| 07/08/2025 | MDLZ | MONDELEZ INTERNATIONAL INC-A | 0.65 | $841,806 | 609207105 | 12,345 |

| 07/08/2025 | SPGI | S&P GLOBAL INC | 0.62 | $806,429 | 78409V104 | 1,532 |

| 07/08/2025 | FI | FISERV INC | 0.61 | $793,476 | 337738108 | 4,656 |

| 07/08/2025 | COF | CAPITAL ONE FINANCIAL CORP | 0.61 | $784,958 | 14040H105 | 3,609 |

| 07/08/2025 | ISRG | INTUITIVE SURGICAL INC | 0.59 | $767,222 | 46120E602 | 1,455 |

| 07/08/2025 | GE | GENERAL ELECTRIC CO | 0.59 | $766,102 | 369604301 | 3,101 |

| 07/08/2025 | CPRT | COPART INC | 0.59 | $759,424 | 217204106 | 15,655 |

| 07/08/2025 | ETN | EATON CORP PLC | 0.58 | $744,303 | G29183103 | 2,085 |

| 07/08/2025 | TXN | TEXAS INSTRUMENTS INC | 0.57 | $739,358 | 882508104 | 3,413 |

| 07/08/2025 | ABT | ABBOTT LABORATORIES COMMON STOCK USD 0 | 0.57 | $735,214 | 2824100 | 5,513 |

| 07/08/2025 | C | CITIGROUP INC | 0.54 | $699,192 | 172967424 | 8,171 |

| 07/08/2025 | AMAT | APPLIED MATERIALS INC | 0.54 | $692,799 | 38222105 | 3,553 |

| 07/08/2025 | AMD | ADVANCED MICRO DEVICES INC | 0.53 | $685,517 | 7903107 | 4,974 |

| 07/08/2025 | CI | CIGNA CORP | 0.53 | $683,592 | 125523100 | 2,191 |

| 07/08/2025 | CME | CME GROUP INC | 0.52 | $676,947 | 12572Q105 | 2,456 |

| 07/08/2025 | MRK | MERCK & CO. INC. | 0.52 | $675,046 | 58933Y105 | 8,296 |

| 07/08/2025 | LRCX | LAM RESH CORP | 0.51 | $658,579 | 512807306 | 6,597 |

| 07/08/2025 | ORLY | OREILLY AUTOMOTIVE INC | 0.51 | $657,700 | 67103H107 | 7,177 |

| 07/08/2025 | CAT | CATERPILLAR INC | 0.51 | $653,733 | 149123101 | 1,658 |

| 07/08/2025 | QCOM | QUALCOMM INC | 0.50 | $649,759 | 747525103 | 4,075 |

| 07/08/2025 | ADI | ANALOG DEVICES INC | 0.50 | $642,538 | 32654105 | 2,621 |

| 07/08/2025 | RTX | RTX Corp. | 0.50 | $641,372 | 7.5513E+105 | 4,426 |

| 07/08/2025 | DE | DEERE & CO | 0.49 | $638,173 | 244199105 | 1,254 |

| 07/08/2025 | NEE | NEXTERA ENERGY INC | 0.48 | $623,591 | 65339F101 | 8,606 |

| 07/08/2025 | PANW | PALO ALTO NETWORKS INC | 0.48 | $616,254 | 697435105 | 3,021 |

| 07/08/2025 | SNPS | SYNOPSYS INC | 0.48 | $614,934 | 871607107 | 1,115 |

| 07/08/2025 | HON | HONEYWELL INTERNATIONAL INC | 0.47 | $607,653 | 438516106 | 2,534 |

| 07/08/2025 | CDNS | CADENCE DESIGN SYS INC | 0.47 | $607,443 | 127387108 | 1,879 |

| 07/08/2025 | MAR | Marriott International, Inc Class A | 0.46 | $590,156 | 571903202 | 2,108 |

| 07/08/2025 | GRMN | GARMIN LTD | 0.45 | $583,036 | H2906T109 | 2,732 |

| 07/08/2025 | ROP | ROPER TECHNOLOGIES INC | 0.44 | $567,413 | 776696106 | 1,005 |

| 07/08/2025 | ICE | INTERCONTINENTAL EXCHANGE IN | 0.43 | $557,237 | 45866F104 | 3,079 |

| 07/08/2025 | WM | WASTE MANAGEMENT INC | 0.43 | $553,630 | 94106L109 | 2,462 |

| 07/08/2025 | DASH | DOORDASH INC CLASS A | 0.43 | $550,793 | 25809K105 | 2,281 |

| 07/08/2025 | MCO | Moodys Corporation | 0.43 | $549,421 | 615369105 | 1,101 |

| 07/08/2025 | KLAC | KLA CORPORATION | 0.42 | $537,744 | 482480100 | 585 |

| 07/08/2025 | RSG | REPUBLIC SERVICES INC | 0.41 | $528,396 | 760759100 | 2,208 |

| 07/08/2025 | TMO | THERMO FISHER SCIENTIFIC INC | 0.40 | $515,240 | 883556102 | 1,209 |

| 07/08/2025 | DHR | DANAHER CORP | 0.39 | $509,125 | 235851102 | 2,537 |

| 07/08/2025 | MU | MICRON TECHNOLOGY INC | 0.38 | $493,699 | 595112103 | 3,968 |

| 07/08/2025 | ABNB | AIRBNB INC | 0.37 | $482,890 | 9066101 | 3,525 |

| 07/08/2025 | CTAS | CINTAS CORP | 0.37 | $477,298 | 172908105 | 2,217 |

| 07/08/2025 | ADP | AUTOMATIC DATA PROCESSING | 0.37 | $476,309 | 53015103 | 1,552 |

| 07/08/2025 | UNP | UNION PACIFIC CORP | 0.36 | $469,532 | 907818108 | 1,985 |

| 07/08/2025 | CB | CHUBB LIMITED | 0.36 | $464,437 | H1467J104 | 1,659 |

| 07/08/2025 | AMGN | AMGEN INC | 0.36 | $459,756 | 31162100 | 1,548 |

| 07/08/2025 | BX | BLACKSTONE GROUP INC/THE | 0.35 | $450,288 | 09260D107 | 2,880 |

| 07/08/2025 | MS | MORGAN STANLEY | 0.34 | $436,656 | 617446448 | 3,094 |

| 07/08/2025 | VRSK | VERISK ANALYTICS INC | 0.33 | $423,859 | 92345Y106 | 1,401 |

| 07/08/2025 | BSX | BOSTON SCIENTIFIC CORP | 0.32 | $419,164 | 101137107 | 4,093 |

| 07/08/2025 | AZO | AUTOZONE INC | 0.32 | $411,629 | 53332102 | 110 |

| 07/08/2025 | GEV-W | GE VERNOVA LLC | 0.32 | $410,750 | 36828A101 | 775 |

| 07/08/2025 | EXPE | EXPEDIA GROUP INC | 0.32 | $409,963 | 30212P303 | 2,309 |

| 07/08/2025 | MCK | MCKESSON CORP | 0.31 | $401,881 | 58155Q103 | 555 |

| 07/08/2025 | MPC | MARATHON PETROLEUM CORP | 0.31 | $398,905 | 56585A102 | 2,217 |

| 07/08/2025 | PNC | PNC FINANCIAL SERVICES GROUP | 0.31 | $396,198 | 693475105 | 2,001 |

| 07/08/2025 | SYK | STRYKER CORP | 0.30 | $387,942 | 863667101 | 996 |

| 07/08/2025 | ADSK | AUTODESK INC | 0.30 | $381,986 | 52769106 | 1,213 |

| 07/08/2025 | PLD | PROLOGIS INC | 0.29 | $379,959 | 74340W103 | 3,556 |

| 07/08/2025 | INTC | INTEL CORP | 0.29 | $379,823 | 458140100 | 16,101 |

| 07/08/2025 | VRTX | VERTEX PHARMACEUTICALS INC | 0.28 | $364,694 | 92532F100 | 782 |

| 07/08/2025 | MDT | MEDTRONIC PLC | 0.28 | $360,698 | G5960L103 | 4,072 |

| 07/08/2025 | ELV | ELEVANCE HEALTH INC COMMON STOCK USD 0.01 | 0.28 | $359,944 | 36752103 | 1,030 |

| 07/08/2025 | ROST | ROSS STORES INC | 0.28 | $358,764 | 778296103 | 2,727 |

| 07/08/2025 | LMT | LOCKHEED MARTIN CORP | 0.28 | $356,981 | 539830109 | 771 |

| 07/08/2025 | BMY | BRISTOL-MYERS SQUIBB CO | 0.27 | $353,835 | 110122108 | 7,522 |

| 07/08/2025 | TTWO | TAKE-TWO INTERACTIVE SOFTWRE | 0.27 | $353,864 | 874054109 | 1,471 |

| 07/08/2025 | FICO | FAIR ISAAC CORP | 0.27 | $349,150 | 303250104 | 205 |

| 07/08/2025 | JBL | JABIL CIRCUIT INC | 0.27 | $345,880 | 466313103 | 1,559 |

| 07/08/2025 | APH | AMPHENOL CORP-CL A | 0.27 | $344,247 | 32095101 | 3,534 |

| 07/08/2025 | BA | BOEING CO | 0.26 | $334,773 | 97023105 | 1,532 |

| 07/08/2025 | FFIV | F5 Inc | 0.26 | $329,627 | 315616102 | 1,090 |

| 07/08/2025 | EA | ELECTRONIC ARTS INC | 0.25 | $325,734 | 285512109 | 2,134 |

| 07/08/2025 | CTSH | COGNIZANT TECH SOLUTIONS-A | 0.24 | $312,993 | 192446102 | 3,878 |

| 07/08/2025 | MO | ALTRIA GROUP INC | 0.24 | $309,787 | 02209S103 | 5,203 |

| 07/08/2025 | MET | METLIFE INC | 0.24 | $308,444 | 59156R108 | 3,872 |

| 07/08/2025 | MMC | MARSH & MCLENNAN COS | 0.24 | $306,112 | 571748102 | 1,436 |

| 07/08/2025 | USB | US BANCORP | 0.24 | $304,738 | 902973304 | 6,394 |

| 07/08/2025 | JCI | JOHNSON CONTROLS | 0.24 | $304,051 | G51502105 | 2,882 |

| 07/08/2025 | CRWD | Crowdstrike Holdings Inc. Class A | 0.23 | $291,933 | 22788C105 | 575 |

| 07/08/2025 | SCHW | The Charles Schwab Corporation | 0.21 | $277,045 | 808513105 | 3,013 |

| 07/08/2025 | EMR | EMERSON ELECTRIC CO | 0.21 | $276,073 | 291011104 | 1,990 |

| 07/08/2025 | CBOE | CBOE HOLDINGS INC | 0.21 | $274,397 | 12503M108 | 1,180 |

| 07/08/2025 | HPE | HEWLETT-PACKARD ENTERPRIS | 0.21 | $273,762 | 42824C109 | 13,149 |

| 07/08/2025 | OMC | OMNICOM GROUP | 0.21 | $271,090 | 681919106 | 3,631 |

| 07/08/2025 | AMT | AMERICAN TOWER CORP | 0.21 | $268,813 | 03027X100 | 1,218 |

| 07/08/2025 | NMAX | NEWSMAX INC CLASS B | 0.21 | $268,710 | 65250K105 | 16,900 |

| 07/08/2025 | CL | COLGATE-PALMOLIVE CO | 0.21 | $266,192 | 194162103 | 2,889 |

| 07/08/2025 | CVS | CVS HEALTH CORP | 0.20 | $256,112 | 126650100 | 3,826 |

| 07/08/2025 | MNST | MONSTER BEVERAGE CORP | 0.20 | $255,599 | 61174X109 | 4,150 |

| 07/08/2025 | EQIX | EQUINIX INC | 0.20 | $254,773 | 29444U700 | 332 |

| 07/08/2025 | KKR | KKR & CO INC -A | 0.19 | $251,741 | 48251W104 | 1,825 |

| 07/08/2025 | FCX | FREEPORT-MCMORAN INC | 0.19 | $242,686 | 35671D857 | 5,245 |

| 07/08/2025 | TSCO | TRACTOR SUPPLY COMPANY | 0.19 | $242,635 | 892356106 | 4,274 |

| 07/08/2025 | HLT | HILTON WORLDWIDE | 0.18 | $238,840 | 43300A203 | 875 |

| 07/08/2025 | TFC | TRUIST FINANCIAL CORP | 0.18 | $237,896 | 89832Q109 | 5,240 |

| 07/08/2025 | AMP | AMERIPRISE FINANCIAL INC | 0.18 | $236,943 | 03076C106 | 442 |

| 07/08/2025 | RBA | RB GLOBAL INC | 0.18 | $236,517 | 74935Q107 | 2,259 |

| 07/08/2025 | ANSS | ANSYS INC | 0.18 | $234,816 | 03662Q105 | 640 |

| 07/08/2025 | FTNT | FORTINET INC | 0.18 | $233,900 | 3.4959E+113 | 2,175 |

| 07/08/2025 | PH | PARKER-HANNIFIN CORP COMMON STOCK USD 0.5 | 0.18 | $233,284 | 701094104 | 330 |

| 07/08/2025 | CASH AND CASH EQUIVALENTS | 0.18 | $232,801 | 232,801 | ||

| 07/08/2025 | TT | TRANE TECHNOLOGIES PLC | 0.18 | $232,655 | G8994E103 | 545 |

| 07/08/2025 | WDAY | WORKDAY INC-CLASS A | 0.18 | $230,611 | 98138H101 | 959 |

| 07/08/2025 | COP | CONOCOPHILLIPS | 0.18 | $230,471 | 20825C104 | 2,406 |

| 07/08/2025 | SHW | SHERWIN-WILLIAMS CO/THE | 0.18 | $227,668 | 824348106 | 658 |

| 07/08/2025 | NXPI | NXP Semiconductors NV | 0.17 | $223,511 | N6596X109 | 962 |

| 07/08/2025 | NOC | NORTHROP GRUMMAN CORP | 0.17 | $221,629 | 666807102 | 439 |

| 07/08/2025 | CSX | CSX CORP | 0.17 | $218,638 | 126408103 | 6,548 |

| 07/08/2025 | ZBRA | ZEBRA TECHNOLOGIES CORP-CL A | 0.16 | $210,312 | 989207105 | 651 |

| 07/08/2025 | ECL | ECOLAB INC | 0.16 | $206,784 | 278865100 | 769 |

| 07/08/2025 | FOXA | FOX CORP - CLASS A | 0.16 | $204,439 | 35137L105 | 3,711 |

| 07/08/2025 | UPS | UNITED PARCEL SERVICE-CL B | 0.15 | $200,255 | 911312106 | 1,956 |

| 07/08/2025 | IPG | Interpublic Group of Companies Inc. | 0.15 | $198,898 | 460690100 | 7,843 |

| 07/08/2025 | COR | Cencora, Inc. | 0.15 | $195,806 | 3.073E+108 | 657 |

| 07/08/2025 | DJT | TRUMP MEDIA & TECHNOLOGY | 0.15 | $194,483 | 25400Q105 | 10,103 |

| 07/08/2025 | AON | Aon plc | 0.15 | $194,304 | G0403H108 | 548 |

| 07/08/2025 | APD | AIR PRODUCTS & CHEMICALS INC | 0.15 | $192,951 | 9158106 | 660 |

| 07/08/2025 | TEL | TE CONNECTIVITY LTD | 0.15 | $188,983 | G87052109 | 1,096 |

| 07/08/2025 | CBRE | CBRE GROUP INC - A | 0.14 | $183,396 | 12504L109 | 1,311 |

| 07/08/2025 | REGN | REGENERON PHARMACEUTICALS | 0.14 | $182,401 | 75886F107 | 333 |

| 07/08/2025 | CMI | CUMMINS INC | 0.14 | $181,251 | 231021106 | 548 |

| 07/08/2025 | HUM | HUMANA INC | 0.14 | $180,967 | 444859102 | 762 |

| 07/08/2025 | RCL | ROYAL CARIBBEAN CRUISES LTD | 0.14 | $180,950 | V7780T103 | 548 |

| 07/08/2025 | CP | CANADIAN PACIFIC RAILWAY LTD | 0.14 | $177,078 | 13646K108 | 2,194 |

| 07/08/2025 | FOX | FOX CORP- CLASS B | 0.14 | $176,906 | 35137L204 | 3,501 |

| 07/08/2025 | UAL | UNITED AIRLINES HOLDINGS INC | 0.14 | $176,713 | 910047109 | 2,176 |

| 07/08/2025 | IT | Gartner Inc | 0.13 | $174,029 | 366651107 | 436 |

| 07/08/2025 | ZTS | ZOETIS INC | 0.13 | $171,213 | 98978V103 | 1,085 |

| 07/08/2025 | ITW | ILLINOIS TOOL WORKS | 0.13 | $169,440 | 452308109 | 657 |

| 07/08/2025 | LHX | L3HARRIS TECHNOLOGIES INC | 0.13 | $169,165 | 502431109 | 658 |

| 07/08/2025 | TDG | TRANSDIGM GROUP INC | 0.13 | $168,311 | 893641100 | 110 |

| 07/08/2025 | CTVA | CORTEVA INC-W/I | 0.13 | $167,273 | 22052L104 | 2,188 |

| 07/08/2025 | NWS | NEWS CORP - CLASS B | 0.13 | $166,426 | 65249B208 | 4,892 |

| 07/08/2025 | WELL | WELLTOWER INC | 0.13 | $166,025 | 95040Q104 | 1,094 |

| 07/08/2025 | DUK | DUKE ENERGY CORP | 0.13 | $163,416 | 26441C204 | 1,405 |

| 07/08/2025 | PSA | PUBLIC STORAGE | 0.12 | $159,079 | 74460D109 | 547 |

| 07/08/2025 | F | FORD MOTOR CO | 0.12 | $159,035 | 345370860 | 13,616 |

| 07/08/2025 | PAYX | PAYCHEX INC | 0.12 | $158,532 | 704326107 | 1,094 |

| 07/08/2025 | GPN | GLOBAL PAYMENTS INC | 0.12 | $157,690 | 37940X102 | 1,955 |

| 07/08/2025 | NWSA | NEWS CORP - CLASS A | 0.12 | $157,694 | 65249B109 | 5,351 |

| 07/08/2025 | FDX | FEDEX CORP | 0.12 | $156,832 | 31428X106 | 657 |

| 07/08/2025 | LAD | Lithia Motors Inc | 0.12 | $155,866 | 536797103 | 451 |

| 07/08/2025 | SLB | SCHLUMBERGER LTD | 0.12 | $151,531 | 806857108 | 4,147 |

| 07/08/2025 | SKX | SKECHERS USA INC-CL A | 0.12 | $150,907 | 830566105 | 2,384 |

| 07/08/2025 | EOG | EOG RESOURCES INC | 0.12 | $148,988 | 26875P101 | 1,202 |

| 07/08/2025 | PCAR | PACCAR INC | 0.12 | $148,741 | 693718108 | 1,507 |

| 07/08/2025 | STZ | CONSTELLATION BRANDS INC-A | 0.11 | $148,549 | 21036P108 | 871 |

| 07/08/2025 | FIS | FIDELITY NATIONAL INFO SERV | 0.11 | $148,042 | 31620M106 | 1,854 |

| 07/08/2025 | OLN | OLIN CORP | 0.11 | $146,474 | 680665205 | 6,592 |

| 07/08/2025 | PINS | PINTEREST INC- CLASS A | 0.11 | $143,719 | 72352L106 | 4,019 |

| 07/08/2025 | STT | STATE STREET CORP | 0.11 | $143,161 | 857477103 | 1,311 |

| 07/08/2025 | LYV | LIVE NATION ENTERTAINMENT IN | 0.11 | $142,119 | 538034109 | 984 |

| 07/08/2025 | KMI | KINDER MORGAN INC | 0.11 | $141,325 | 49456B101 | 5,024 |

| 07/08/2025 | FAST | FASTENAL CO | 0.11 | $140,601 | 311900104 | 3,282 |

| 07/08/2025 | EBAY | EBAY INC | 0.11 | $138,532 | 278642103 | 1,839 |

| 07/08/2025 | CEG | CONSTELLATION ENERGY CORPORATION | 0.11 | $137,337 | 21037T109 | 439 |

| 07/08/2025 | MANH | MANHATTAN ASSOCIATES INC | 0.11 | $136,248 | 562750109 | 672 |

| 07/08/2025 | GILD | GILEAD SCIENCES INC | 0.10 | $134,716 | 375558103 | 1,213 |

| 07/08/2025 | BDX | BECTON DICKINSON AND CO | 0.10 | $133,941 | 75887109 | 767 |

| 07/08/2025 | FITB | FIFTH THIRD BANCORP | 0.10 | $132,914 | 316773100 | 3,059 |

| 07/08/2025 | MMM | 3M CO | 0.10 | $132,678 | 88579Y101 | 863 |

| 07/08/2025 | HPQ | HP INC | 0.10 | $132,019 | 40434L105 | 5,117 |

| 07/08/2025 | DLR | DIGITAL REALTY TRUST INC | 0.10 | $130,833 | 253868103 | 766 |

| 07/08/2025 | BLDR | BUILDERS FIRSTSOURCE INC | 0.10 | $126,604 | 12008R107 | 995 |

| 07/08/2025 | RGR | STURM RUGER & CO INC | 0.10 | $124,166 | 864159108 | 3,430 |

| 07/08/2025 | CCI | CROWN CASTLE INTL CORP | 0.10 | $123,609 | 22822V101 | 1,205 |

| 07/08/2025 | HCA | HCA HEALTHCARE INC | 0.09 | $122,720 | 40412C101 | 325 |

| 07/08/2025 | NEM | NEWMONT GOLDCORP CORPORATION COM | 0.09 | $119,541 | 651639106 | 2,075 |

| 07/08/2025 | WMB | WILLIAMS COMPANIES INC. | 0.09 | $119,591 | 969457100 | 2,073 |

| 07/08/2025 | EW | EDWARDS LIFESCIENCES CORP | 0.09 | $117,106 | 2.8176E+112 | 1,533 |

| 07/08/2025 | DHI | DR HORTON INC | 0.09 | $115,080 | 23331A109 | 876 |

| 07/08/2025 | GWW | WW GRAINGER INC | 0.09 | $115,065 | 384802104 | 111 |

| 07/08/2025 | DG | DOLLAR GEN CORP NEW | 0.09 | $112,577 | 256677105 | 999 |

| 07/08/2025 | RKT | ROCKET COS INC CLASS A COMMON STOCK USD.00001 | 0.09 | $110,758 | 77311W101 | 8,061 |

| 07/08/2025 | NTRS | NORTHERN TRUST CORP | 0.09 | $109,963 | 665859104 | 873 |

| 07/08/2025 | GLW | CORNING INC | 0.08 | $109,626 | 219350105 | 2,079 |

| 07/08/2025 | CAH | CARDINAL HEALTH INC | 0.08 | $107,057 | 14149Y108 | 651 |

| 07/08/2025 | NUE | NUCOR CORP | 0.08 | $106,335 | 670346105 | 761 |

| 07/08/2025 | RJF | RAYMOND JAMES | 0.08 | $103,530 | 754730109 | 657 |

| 07/08/2025 | MGM | MGM Resorts International | 0.08 | $102,617 | 552953101 | 2,735 |

| 07/08/2025 | WTW | WTW | 0.08 | $100,985 | G96629103 | 331 |

| 07/08/2025 | KMB | Kimberly-Clark Corp | 0.08 | $100,521 | 494368103 | 765 |

| 07/08/2025 | OXY | OCCIDENTAL PETROLEUM CORP | 0.08 | $100,147 | 674599105 | 2,189 |

| 07/08/2025 | BK | BANK OF NEW YORK MELLON CORP | 0.08 | $98,993 | 64058100 | 1,068 |

| 07/08/2025 | PEG | PUBLIC SERVICE ENTERPRISE GP | 0.08 | $98,083 | 744573106 | 1,202 |

| 07/08/2025 | SWBI | Smith & Wesson Brands Inc | 0.08 | $98,100 | 831754106 | 11,407 |

| 07/08/2025 | RF | REGIONS FINANCIAL CORP | 0.08 | $96,914 | 7591EP100 | 3,930 |

| 07/08/2025 | DRI | DARDEN RESTAURANTS INC | 0.07 | $95,975 | 237194105 | 441 |

| 07/08/2025 | GD | GENERAL DYNAMICS CORP | 0.07 | $95,521 | 369550108 | 322 |

| 07/08/2025 | HIG | HARTFORD FINANCIAL SVCS GRP | 0.07 | $93,927 | 416515104 | 767 |

| 07/08/2025 | ADM | ARCHER-DANIELS-MIDLAND CO | 0.07 | $93,335 | 39483102 | 1,711 |

| 07/08/2025 | WAB | WABTEC CORP | 0.07 | $92,124 | 929740108 | 435 |

| 07/08/2025 | BKR | Baker Hughes Company | 0.07 | $91,932 | 05722G100 | 2,292 |

| 07/08/2025 | CARR | CARRIER GLOBAL CORP-W/I | 0.07 | $90,030 | 14448C104 | 1,202 |

| 07/08/2025 | SPG | SIMON PROPERTY GROUP INC | 0.07 | $88,917 | 828806109 | 544 |

| 07/08/2025 | XEL | XCEL ENERGY INC | 0.07 | $88,639 | 98389B100 | 1,312 |

| 07/08/2025 | CFG | CITIZENS FINANCIAL GROUP | 0.07 | $88,168 | 174610105 | 1,855 |

| 07/08/2025 | EFX | EQUIFAX INC | 0.07 | $86,909 | 294429105 | 329 |

| 07/08/2025 | VLTO | VERALTO CORP-W/I | 0.07 | $86,571 | 92338C103 | 846 |

| 07/08/2025 | MCHP | MICROCHIP TECHNOLOGY INC | 0.06 | $81,569 | 595017104 | 1,094 |

| 07/08/2025 | OKE | ONEOK INC | 0.06 | $79,968 | 682680103 | 980 |

| 07/08/2025 | AME | AMETEK INC | 0.06 | $78,879 | 31100100 | 435 |

| 07/08/2025 | BR | Broadridge Financial Solutions, Inc. | 0.06 | $78,385 | 11133T103 | 330 |

| 07/08/2025 | STX | SEAGATE TECHNOLOGY-ORDINARY SHARES | 0.06 | $78,014 | G7997R103 | 540 |

| 07/08/2025 | IP | INTERNATIONAL PAPER CO | 0.06 | $77,469 | 460146103 | 1,531 |

| 07/08/2025 | PPG | PPG INDUSTRIES INC | 0.06 | $77,138 | 693506107 | 657 |

| 07/08/2025 | TROW | T ROWE PRICE GROUP INC | 0.06 | $76,501 | 74144T108 | 767 |

| 07/08/2025 | IR | INGERSOLL RAND INC | 0.06 | $76,221 | 45687V106 | 876 |

| 07/08/2025 | GEHC | GE HEALTHCARE TECHNOLOG-W/I | 0.06 | $74,974 | 36266G107 | 997 |

| 07/08/2025 | LUV | SOUTHWEST AIRLINES CO | 0.06 | $74,280 | 844741108 | 2,186 |

| 07/08/2025 | ODFL | Old Dominion Freight Line Inc. | 0.06 | $73,982 | 679580100 | 442 |

| 07/08/2025 | DXCM | DEXCOM INC | 0.06 | $73,709 | 252131107 | 880 |

| 07/08/2025 | LEN | LENNAR CORP-A | 0.06 | $72,215 | 526057104 | 654 |

| 07/08/2025 | IQV | IQVIA HOLDINGS INC COMMON STOCK USD.01 | 0.06 | $71,873 | 46266C105 | 437 |

| 07/08/2025 | KEYS | KEYSIGHT TEC | 0.06 | $71,617 | 49338L103 | 438 |

| 07/08/2025 | ETSY | ETSY INC | 0.05 | $70,300 | 29786A106 | 1,315 |

| 07/08/2025 | GPC | GENUINE PARTS CO | 0.05 | $69,674 | 372460105 | 550 |

| 07/08/2025 | AJG | ARTHUR J GALLAGHER & CO | 0.05 | $69,341 | 363576109 | 221 |

| 07/08/2025 | WEC | WEC ENERGY GROUP INC | 0.05 | $68,416 | 92939U106 | 660 |

| 07/08/2025 | GIS | GENERAL MILLS INC | 0.05 | $68,118 | 370334104 | 1,314 |

| 07/08/2025 | AFL | AFLAC INC | 0.05 | $67,725 | 1055102 | 656 |

| 07/08/2025 | AVB | AVALONBAY COMMUNITIES INC | 0.05 | $66,687 | 53484101 | 331 |

| 07/08/2025 | A | AGILENT TECHNOLOGIES INC | 0.05 | $66,313 | 00846U101 | 548 |

| 07/08/2025 | AAL | AMERICAN AIRLINES GROUP INC | 0.05 | $65,751 | 02376R102 | 5,678 |

| 07/08/2025 | EQR | EQUITY RESIDENTIAL | 0.05 | $65,621 | 29476L107 | 985 |

| 07/08/2025 | MSCI | MSCI INC | 0.05 | $65,069 | 55354G100 | 112 |

| 07/08/2025 | OTIS | OTIS WORLDWIDE CORP-W/I | 0.05 | $64,991 | 68902V107 | 652 |

| 07/08/2025 | LVS | LAS VEGAS SANDS CORP | 0.05 | $64,481 | 517834107 | 1,313 |

| 07/08/2025 | CINF | CINCINNATI FINANCIAL CORP | 0.05 | $64,426 | 172062101 | 441 |

| 07/08/2025 | BALL | BALL CORP | 0.05 | $64,283 | 58498106 | 1,094 |

| 07/08/2025 | AIG | AMERICAN INTERNATIONAL GROUP | 0.05 | $64,064 | 26874784 | 770 |

| 07/08/2025 | APTV.UN | APTIV HOLDINGS LTD COMMON STOCK USD 0.01 | 0.05 | $62,528 | G3265R107 | 875 |

| 07/08/2025 | TYL | TYLER TECHNOLOGIES INC | 0.05 | $61,430 | 902252105 | 105 |

| 07/08/2025 | NSC | NORFOLK SOUTHERN CORP | 0.05 | $60,860 | 655844108 | 233 |

| 07/08/2025 | TPR | TAPESTRY INC COMMON STOCK USD.01 | 0.05 | $60,674 | 876030107 | 658 |

| 07/08/2025 | IDXX | IDEXX LABS | 0.05 | $60,350 | 45168D104 | 112 |

| 07/08/2025 | CDW | CDW CORP/DE | 0.05 | $59,795 | 12514G108 | 331 |

| 07/08/2025 | UA | UNDER ARMOUR INC-CLASS C | 0.05 | $59,451 | 904311206 | 8,940 |

| 07/08/2025 | VEEV | VEEVA SYSTEMS INC-CLASS A | 0.05 | $59,494 | 922475108 | 212 |

| 07/08/2025 | HBAN | HUNTINGTON BANCSHARES INC | 0.05 | $59,222 | 446150104 | 3,388 |

| 07/08/2025 | TRV | The Travelers Companies Inc. | 0.05 | $58,201 | 8.9417E+113 | 227 |

| 07/08/2025 | DTE | DTE ENERGY COMPANY | 0.04 | $57,575 | 233331107 | 442 |

| 07/08/2025 | DLTR | DOLLAR TREE INC | 0.04 | $56,684 | 256746108 | 543 |

| 07/08/2025 | FE | FIRSTENERGY CORP | 0.04 | $56,763 | 337932107 | 1,423 |

| 07/08/2025 | RMD | RESMED INC | 0.04 | $56,706 | 761152107 | 221 |

| 07/08/2025 | LH | LABCORP HLDGS INC USD 0.1 | 0.04 | $56,639 | 504922105 | 220 |

| 07/08/2025 | ES | EVERSOURCE ENERGY | 0.04 | $56,490 | 30040W108 | 875 |

| 07/08/2025 | HSY | HERSHEY CO/THE | 0.04 | $56,247 | 427866108 | 331 |

| 07/08/2025 | DD | DUPONT DE NEMOURS INC | 0.04 | $55,629 | 26614N102 | 747 |

| 07/08/2025 | BBY | BEST BUY CO INC | 0.04 | $55,336 | 86516101 | 766 |

| 07/08/2025 | UAA | UNDER ARMOUR INC-CLASS A | 0.04 | $55,055 | 904311107 | 7,865 |

| 07/08/2025 | KHC | KRAFT HEINZ CO/THE | 0.04 | $54,922 | 500754106 | 2,078 |

| 07/08/2025 | CHD | CHURCH & DWIGHT CO INC | 0.04 | $53,726 | 171340102 | 548 |

| 07/08/2025 | KR | KROGER CO | 0.04 | $53,351 | 501044101 | 765 |

| 07/08/2025 | ULTA | Ulta Beauty Inc. | 0.04 | $53,153 | 90384S303 | 110 |

| 07/08/2025 | EXPD | EXPEDITORS INTL WASH INC | 0.04 | $51,621 | 302130109 | 440 |

| 07/08/2025 | YUM | YUM! BRANDS INC | 0.04 | $51,030 | 988498101 | 339 |

| 07/08/2025 | DPZ | Dominos Pizza INC | 0.04 | $50,537 | 25754A201 | 110 |

| 07/08/2025 | L | LOEWS CORP | 0.04 | $49,318 | 540424108 | 538 |

| 07/08/2025 | HES | HESS CORP | 0.04 | $49,275 | 42809H107 | 328 |

| 07/08/2025 | AMCR | AMCOR PLC | 0.04 | $48,285 | G0250X107 | 4,917 |

| 07/08/2025 | HAL | HALLIBURTON CO | 0.04 | $48,331 | 406216101 | 2,181 |

| 07/08/2025 | PRU | PRUDENTIAL FINANCIAL INC | 0.04 | $47,550 | 744320102 | 442 |

| 07/08/2025 | EL | ESTEE LAUDER | 0.04 | $46,887 | 518439104 | 548 |

| 07/08/2025 | AEP | AMERICAN ELECTRIC POWER | 0.04 | $46,366 | 25537101 | 446 |

| 07/08/2025 | EXC | EXELON CORP | 0.04 | $46,010 | 30161N101 | 1,070 |

| 07/08/2025 | WY | WEYERHAEUSER CO | 0.04 | $45,667 | 962166104 | 1,745 |

| 07/08/2025 | PKG | Packaging Corp. of America | 0.03 | $44,812 | 695156109 | 221 |

| 07/08/2025 | EIX | EDISON INTERNATIONAL | 0.03 | $43,890 | 281020107 | 865 |

| 07/08/2025 | ILMN | ILLUMINA INC | 0.03 | $43,480 | 452327109 | 438 |

| 07/08/2025 | J | JACOBS SOLUTIONS INC COMMON STOCK | 0.03 | $43,355 | 46982L108 | 326 |

| 07/08/2025 | ALKEY | KEYCORP | 0.03 | $42,412 | 493267108 | 2,295 |

| 07/08/2025 | LYB | LYONDELLBASELL INDUSTRIES NV COMMON STOCK USD 0.04 | 0.03 | $41,596 | N53745100 | 653 |

| 07/08/2025 | PWR | QUANTA SERVICES INC | 0.03 | $41,532 | 7.4762E+106 | 110 |

| 07/08/2025 | VTR | Ventas Inc. | 0.03 | $40,857 | 92276F100 | 651 |

| 07/08/2025 | FTV | FORTIVE CORP | 0.03 | $40,603 | 34959J108 | 769 |

| 07/08/2025 | SYY | SYSCO CORP | 0.03 | $40,255 | 871829107 | 526 |

| 07/08/2025 | CNC | CENTENE CORP | 0.03 | $39,087 | 15135B101 | 1,199 |

| 07/08/2025 | CNP | CENTERPOINT ENERGY INC | 0.03 | $39,094 | 15189T107 | 1,092 |

| 07/08/2025 | ROK | ROCKWELL AUTOMATION INC | 0.03 | $37,197 | 773903109 | 110 |

| 07/08/2025 | KSS | Kohls Corp | 0.03 | $36,847 | 500255104 | 4,058 |

| 07/08/2025 | PHM | PULTEGROUP INC | 0.03 | $36,039 | 745867101 | 331 |

| 07/08/2025 | WYNN | WYNN RESORTS LTD | 0.03 | $36,010 | 983134107 | 326 |

| 07/08/2025 | D | DOMINION RESOURCES INC/VA | 0.03 | $35,763 | 25746U109 | 635 |

| 07/08/2025 | PFG | PRINCIPAL FINANCIAL GROUP | 0.03 | $35,770 | 74251V102 | 439 |

| 07/08/2025 | SRE | SEMPRA ENERGY | 0.03 | $34,633 | 816851109 | 466 |

| 07/08/2025 | BWA | BORGWARNER INC | 0.03 | $34,516 | 99724106 | 980 |

| 07/08/2025 | POOL | POOL CORP | 0.03 | $33,290 | 73278L105 | 110 |

| 07/08/2025 | CHRW | C.H. ROBINSON WORLDWIDE INC | 0.03 | $32,744 | 12541W209 | 333 |

| 07/08/2025 | COO | COOPER COS INC | 0.03 | $32,674 | 216648501 | 440 |

| 07/08/2025 | WBA | WALGREENS BOOTS ALLIANCE INC | 0.03 | $32,740 | 931427108 | 2,842 |

| 07/08/2025 | MOS | MOSAIC CO/THE | 0.03 | $32,572 | 61945C103 | 873 |

| 07/08/2025 | BBWI | Bath & Body Works Inc | 0.03 | $32,438 | 70830104 | 968 |

| 07/08/2025 | MKC | MCCORMICK-N/V | 0.02 | $31,930 | 579780206 | 438 |

| 07/08/2025 | ZBH | ZIMMER BIOMET HOLDINGS INC | 0.02 | $31,593 | 98956P102 | 338 |

| 07/08/2025 | AWK | AMERICAN WATER WORKS CO INC | 0.02 | $31,165 | 30420103 | 221 |

| 07/08/2025 | RL | RALPH LAUREN CORP | 0.02 | $31,056 | 751212101 | 109 |

| 07/08/2025 | O | REALTY INCOME CORP | 0.02 | $30,700 | 756109104 | 534 |

| 07/08/2025 | VMC | VULCAN MATERIALS CO | 0.02 | $29,310 | 929160109 | 110 |

| 07/08/2025 | XYL | Xylem Inc/NY | 0.02 | $29,042 | 98419M100 | 221 |

| 07/08/2025 | SW | SMURFIT WESTROCK PLC | 0.02 | $25,822 | G8267P108 | 548 |

| 07/08/2025 | PAYC | PAYCOM SOFTWARE INC | 0.02 | $25,737 | 70432V102 | 110 |

| 07/08/2025 | DOW | DOW INC | 0.02 | $25,311 | 260557103 | 871 |

| 07/08/2025 | LKQ | LKQ CORP | 0.02 | $25,244 | 501889208 | 654 |

| 07/08/2025 | MKTX | MarketAxess Holdings Inc. | 0.02 | $23,850 | 57060D108 | 110 |

| 07/08/2025 | SBAC | SBA COMMUNICATIONS CORP | 0.02 | $23,892 | 78410G104 | 102 |

| 07/08/2025 | INCY | Incyte Corp. | 0.02 | $22,534 | 45337C102 | 333 |

| 07/08/2025 | HOLX | HOLOGIC INC | 0.02 | $21,287 | 436440101 | 328 |

| 07/08/2025 | HST | HOST HOTELS & RESORTS INC | 0.02 | $21,099 | 44107P104 | 1,304 |

| 07/08/2025 | BF B | BROWN-FORMAN CORP | 0.01 | $18,933 | 115637209 | 665 |

| 07/08/2025 | BIIB | BIOGEN INC | 0.01 | $17,480 | 09062X103 | 130 |

| 07/08/2025 | ARE | Alexandria Real Estate Equitie | 0.01 | $17,021 | 15271109 | 221 |

| 07/08/2025 | HAS | HASBRO INC | 0.01 | $16,985 | 418056107 | 222 |

| 07/08/2025 | JBHT | JB Hunt Transport Services, Inc. | 0.01 | $16,836 | 445658107 | 110 |

| 07/08/2025 | EXR | EXTRA SPACE STORAGE INC | 0.01 | $16,631 | 30225T102 | 111 |

| 07/08/2025 | IFF | INTERNATIONAL FLAVORS & FRAGRANCES | 0.01 | $16,683 | 459506101 | 219 |

| 07/08/2025 | MAA | MID-AMERICA APARTMENT COMM | 0.01 | $16,679 | 59522J103 | 111 |

| 07/08/2025 | PVH | PVH CORP | 0.01 | $16,173 | 693656100 | 219 |

| 07/08/2025 | SOLV | SOLVENTUM CORP W/I COMMON STOCK | 0.01 | $16,142 | 83444M101 | 215 |

| 07/08/2025 | BEN | FRANKLIN RESOURCES INC | 0.01 | $15,974 | 354613101 | 652 |

| 07/08/2025 | SYF | SYNCHRONY FINANCIAL | 0.01 | $15,313 | 87165B103 | 221 |

| 07/08/2025 | CLX | CLOROX COMPANY | 0.01 | $12,974 | 189054109 | 103 |

| 07/08/2025 | AAP | ADVANCE AUTO PARTS INC | 0.01 | $12,256 | 00751Y106 | 220 |

| 07/08/2025 | RAL-W | RALLIANT CORP RAL-W | 0.01 | $12,288 | 750940108 | 256 |

| 07/08/2025 | ED | CONSOLIDATED EDISON INC | 0.01 | $10,725 | 209115104 | 108 |

| 07/08/2025 | PHIN | PHINIA Inc. | 0.01 | $9,660 | 71880K101 | 205 |

| 07/08/2025 | AEE | AMEREN CORPORATION | 0.01 | $9,310 | 23608102 | 98 |

| 07/08/2025 | MRP-W | MILLROSE PROPERTIES-CL A W/I | 0.01 | $8,831 | 601137102 | 321 |

| 07/08/2025 | AMTM-W | Amentum Holdings Inc | 0.01 | $8,349 | 23939101 | 345 |

| 07/08/2025 | ALB | ALBEMARLE CORP | 0.01 | $7,724 | 12653101 | 110 |

| 07/08/2025 | AES | LIBERTY MEDIA COR-SIRIUSXM A | 0.01 | $7,207 | 00130H105 | 651 |

| 07/08/2025 | CE | Celanese Corp | 0.01 | $6,700 | 150870103 | 111 |

| 07/08/2025 | SLVM | SYLVAMO CORP WHEN ISSUED | 0.00 | $6,142 | 871332102 | 118 |

| 07/08/2025 | IVZ | INVESCO LTD | 0.00 | $5,558 | G491BT108 | 333 |

| 07/08/2025 | FMC | FMC CORP | 0.00 | $4,806 | 302491303 | 111 |

| 07/08/2025 | GRALV US | GRAIL INC COMMON STOCK USD | 0.00 | $3,342 | 384747101 | 78 |

| 07/08/2025 | EMBC | EMBECTA CORP-W/I | 0.00 | $1,314 | 29082K105 | 126 |

| 07/08/2025 | MTD | METTLER-TOLEDO | 0.00 | $1,207 | 592688105 | 1 |

| 07/08/2025 | FTRE | Fortrea Holdings Inc. | 0.00 | $1,054 | 34965K107 | 220 |